Is This REIT’s Dividend Just What the Doctor Ordered?

Physicians Realty Trust (NYSE: DOC) is a healthcare real estate investment trust (REIT). It builds, buys, sells and manages medical buildings. Its medical office portfolio is worth more than $4.2 billion.

The company makes money by collecting rent from its tenants, the doctors and other medical professionals who lease space from it. Its cash flow is directly tied to the healthcare market.

And right now, the healthcare industry is going gangbusters.

Spending on healthcare reached a record $3.6 trillion a year last month. It’s predicted to rise 5.3% in 2018. And it should continue to head north for the next decade.

The Centers for Medicare and Medicaid Services estimates healthcare will make up nearly 20% of the U.S. economy by 2026.

One of the biggest drivers of this growth is something we all have in common: We’re all getting older.

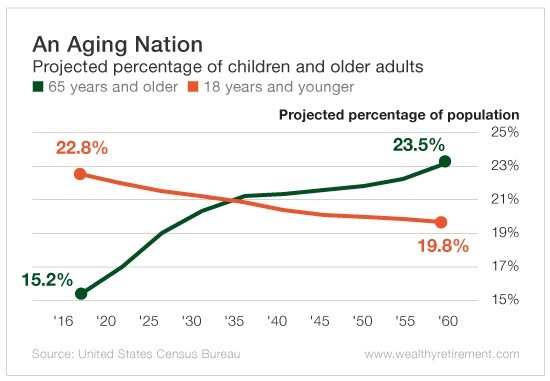

In fact, the U.S. Census Bureau predicts that by 2035, people 65 years and older will outnumber children 18 years and younger for the first time in U.S. history…

Typically, older people need more healthcare. The country needs more doctors and other medical providers to meet that demand. In turn, these medical professionals will need more office space.

This trend is good news for Physicians Realty Trust. More tenants mean higher occupancy rates and higher rents.

That should be even better news for the REIT’s cash flow and its 6% dividend yield.

Physicians Realty Trust began paying dividends shortly after it went public in 2013. There have been a few small raises since then and zero cuts.

Last year, the healthcare REIT paid out $0.92 per share in dividends. Funds from operations (FFO), a measure of cash flow for REITs, were $0.94 per share. FFO covered the dividend in 2017, but not by much.

In 2018, Bloomberg analysts expect Physicians Realty Trust to generate $1.11 per share. That’s an 18% jump in the right direction.

These same analysts also expect the company to raise its dividend by a penny this year to $0.93, leaving it well covered.

With occupancy levels north of 96% at the end of 2017, Physicians Realty Trust will need to acquire and fill new medical office properties to keep FFO growing.

But as long as FFO continues upward, the dividend will be safe.

Dividend Safety Rating: B

If you have a stock whose dividend safety you’d like Marc to analyze, leave the ticker symbol in the comments section below.

Good investing,

Kristin

oprol evorter

I?¦ve recently started a web site, the information you provide on this site has helped me tremendously. Thanks for all of your time & work.

Jeremy Renner Hawkeye Leather Vest

It¦s actually a cool and useful piece of information. I am happy that you shared this useful information with us. Please stay us informed like this. Thanks for sharing.

Erin

Hi, very nice website, cheers! ------------------------------------------------------ Need cheap and reliable hosting? Our shared plans start at $10 for an year and VPS plans for $6/Mo. ------------------------------------------------------ Check here: https://www.good-webhosting.com/

security

Very interesting details you have observed, regards for putting up. "Pleasure and love are the pinions of great deeds." by Charles Fox.

here

With havin so much written content do you ever run into any problems of plagorism or copyright violation? My site has a lot of unique content I've either written myself or outsourced but it seems a lot of it is popping it up all over the web without my permission. Do you know any solutions to help reduce content from being ripped off? I'd truly appreciate it.

acim videos

It¦s actually a great and helpful piece of information. I am happy that you shared this useful info with us. Please keep us up to date like this. Thanks for sharing.

spiri app

I'd perpetually want to be update on new articles on this web site, saved to favorites! .

forex

It’s really a cool and helpful piece of info. I’m happy that you just shared this useful information with us. Please stay us informed like this. Thank you for sharing.

credit control

I was examining some of your articles on this site and I think this website is really instructive! Keep on posting.

https://cbd-campus.com/

Well I sincerely enjoyed studying it. This tip offered by you is very useful for accurate planning.

https://cbd-campus.com/

I do not even know how I ended up here, but I thought this post was good. I don't know who you are but definitely you're going to a famous blogger if you aren't already ;) Cheers!

have a peek at this web-site

great submit, very informative. I ponder why the other specialists of this sector don't realize this. You must continue your writing. I am sure, you've a huge readers' base already!

check out the post right here

I see something really special in this website .

helpful hints

Glad to be one of the visitants on this awing web site : D.

try here

Hi, i think that i saw you visited my site thus i came to “return the favor”.I am attempting to find things to improve my site!I suppose its ok to use a few of your ideas!!

go to my site

Its superb as your other articles : D, regards for posting.

read more

certainly like your web site however you need to take a look at the spelling on several of your posts. A number of them are rife with spelling problems and I in finding it very bothersome to tell the reality however I’ll certainly come back again.

review

Hello, you used to write great, but the last few posts have been kinda boringK I miss your tremendous writings. Past several posts are just a bit out of track! come on!

anabole steroide kaufen

An impressive share, I just given this onto a colleague who was doing a little analysis on this. And he in fact bought me breakfast because I found it for him.. smile. So let me reword that: Thnx for the treat! But yeah Thnkx for spending the time to discuss this, I feel strongly about it and love reading more on this topic. If possible, as you become expertise, would you mind updating your blog with more details? It is highly helpful for me. Big thumb up for this blog post!

Buy Quality Products for Weight Loss

I have been examinating out many of your posts and i must say pretty clever stuff. I will surely bookmark your blog.

Comprare Steroidi Anabolizzanti

You made certain fine points there. I did a search on the issue and found the majority of people will have the same opinion with your blog.

steroide online bestellen

I saw a lot of website but I believe this one has got something special in it in it

Buy Salbutamol

I visited a lot of website but I think this one holds something extra in it in it

given

I like the helpful info you provide in your articles. I will bookmark your blog and check again here regularly. I am quite sure I will learn many new stuff right here! Best of luck for the next!

Wisconsin Car Shipping

What’s Happening i am new to this, I stumbled upon this I have found It absolutely helpful and it has aided me out loads. I hope to contribute & aid other users like its helped me. Good job.

Workshop chocolade maken

It is truly a great and helpful piece of information. I am happy that you shared this useful information with us. Please keep us informed like this. Thanks for sharing.

Wisconsin Car Shipping

Thank you a bunch for sharing this with all people you actually recognise what you are speaking about! Bookmarked. Kindly additionally seek advice from my website =). We will have a hyperlink alternate arrangement among us!

Mobile Wins Casino bonus

With havin so much content and articles do you ever run into any problems of plagorism or copyright infringement? My site has a lot of exclusive content I've either written myself or outsourced but it seems a lot of it is popping it up all over the web without my permission. Do you know any ways to help stop content from being ripped off? I'd genuinely appreciate it.

executive coaching

As a Newbie, I am constantly exploring online for articles that can be of assistance to me. Thank you

description

Terrific work! This is the type of info that should be shared around the internet. Shame on Google for not positioning this post higher! Come on over and visit my website . Thanks =)

camabi

I've been absent for a while, but now I remember why I used to love this website. Thanks, I'll try and check back more often. How frequently you update your website?

pacific national funding

A lot of of whatever you say is astonishingly legitimate and it makes me wonder why I hadn't looked at this with this light previously. This article really did turn the light on for me as far as this specific subject matter goes. Nevertheless at this time there is just one factor I am not necessarily too comfy with and while I attempt to reconcile that with the actual core theme of the position, permit me see what the rest of your readers have to say.Nicely done.

click reference

I dugg some of you post as I thought they were very beneficial extremely helpful

pacific national funding legit

Currently it sounds like Wordpress is the top blogging platform out there right now. (from what I've read) Is that what you're using on your blog?

new fidelity funding reviews

I'd always want to be update on new posts on this internet site, saved to my bookmarks! .

new fidelity funding ratings

Excellent blog here! Also your web site loads up very fast! What host are you using? Can I get your affiliate link to your host? I wish my web site loaded up as fast as yours lol

this article

Good day! Would you mind if I share your blog with my facebook group? There's a lot of people that I think would really enjoy your content. Please let me know. Thank you

214146

331868

swttm88sdfza2v2wpi21uvojrlkrb82c6bn1c

t1fhrudei14w7h7iu47nzht5w7pdgu7ybxsnh

click now

This blog is definitely rather handy since I’m at the moment creating an internet floral website – although I am only starting out therefore it’s really fairly small, nothing like this site. Can link to a few of the posts here as they are quite. Thanks much. Zoey Olsen

pop art

I truly appreciate this post. I?¦ve been looking everywhere for this! Thank goodness I found it on Bing. You've made my day! Thanks again

ego aio

he blog was how do i say it… relevant, finally something that helped me. Thanks

tagass

Appreciating the dedication you put into your blog and in depth information you present. It's good to come across a blog every once in a while that isn't the same old rehashed material. Great read! I've saved your site and I'm including your RSS feeds to my Google account.

my blog

But wanna remark on few general things, The website design and style is perfect, the written content is really great : D.

her response

Hello. impressive job. I did not anticipate this. This is a impressive story. Thanks!

free acim workbook lessons

I've been surfing online greater than 3 hours lately, yet I by no means found any attention-grabbing article like yours. It is lovely worth sufficient for me. In my opinion, if all webmasters and bloggers made good content as you probably did, the net might be a lot more helpful than ever before.

smoretraiolit

Thanks for the article, can you make it so I receive an alert email whenever you make a fresh update?

Charlottesville drain cleaning

Thank you for sharing excellent informations. Your site is so cool. I am impressed by the details that you have on this website. It reveals how nicely you understand this subject. Bookmarked this web page, will come back for extra articles. You, my friend, ROCK! I found just the info I already searched all over the place and just could not come across. What an ideal website.

custom home builders Charleston

I'm really impressed with your writing skills as well as with the layout on your weblog. Is this a paid theme or did you customize it yourself? Either way keep up the excellent quality writing, it’s rare to see a nice blog like this one nowadays..

Charleston wedding photographers

I do agree with all of the ideas you've presented in your post. They're really convincing and will definitely work. Still, the posts are too short for novices. Could you please extend them a little from next time? Thanks for the post.

Lynchburg top restaurants

I visited a lot of website but I think this one has got something special in it in it

Tutos

Hello. excellent job. I did not imagine this. This is a splendid story. Thanks!

click here

Appreciate it for all your efforts that you have put in this. very interesting information.

erjilopterin

Hi there, just became aware of your blog through Google, and found that it is really informative. I am gonna watch out for brussels. I will appreciate if you continue this in future. A lot of people will be benefited from your writing. Cheers!

visit homepage

Hey very cool website!! Man .. Beautiful .. Amazing .. I will bookmark your blog and take the feeds also…I'm happy to find a lot of useful information here in the post, we need develop more strategies in this regard, thanks for sharing. . . . . .

Butane Fuel Canister 150ml/70g

Great info and straight to the point. I am not sure if this is actually the best place to ask but do you guys have any thoughts on where to hire some professional writers? Thank you :)

there

of course like your web-site however you need to test the spelling on quite a few of your posts. Many of them are rife with spelling problems and I find it very bothersome to inform the truth on the other hand I?¦ll surely come back again.

go to these guys

We are a group of volunteers and starting a brand new scheme in our community. Your website provided us with valuable information to paintings on. You've done an impressive activity and our entire community can be thankful to you.

fridge repair Greensboro

Can I just say what a relief to find someone who actually knows what theyre talking about on the internet. You definitely know how to bring an issue to light and make it important. More people need to read this and understand this side of the story. I cant believe youre not more popular because you definitely have the gift.

Greensboro dryer repair

I?¦ve recently started a web site, the information you offer on this site has helped me greatly. Thank you for all of your time & work.

svolrfinotews

Hey there just wanted to give you a quick heads up. The words in your post seem to be running off the screen in Firefox. I'm not sure if this is a format issue or something to do with browser compatibility but I thought I'd post to let you know. The design and style look great though! Hope you get the problem fixed soon. Thanks

svolrfinotews

Appreciate it for helping out, great info .

lessen Sie hier weiter

Do you mind if I quote a couple of your posts as long as I provide credit and sources back to your weblog? My website is in the exact same niche as yours and my visitors would certainly benefit from some of the information you present here. Please let me know if this ok with you. Cheers!

this content

Hi there, just became aware of your blog through Google, and found that it's truly informative. I am going to watch out for brussels. I’ll appreciate if you continue this in future. Numerous people will be benefited from your writing. Cheers!

check that

Hi, i read your blog from time to time and i own a similar one and i was just curious if you get a lot of spam comments? If so how do you stop it, any plugin or anything you can suggest? I get so much lately it's driving me insane so any support is very much appreciated.

steroids

You have brought up a very great points, regards for the post.

grolyrto lemcs

Whats Happening i am new to this, I stumbled upon this I've discovered It absolutely useful and it has helped me out loads. I'm hoping to give a contribution & help other users like its aided me. Good job.

vpm

Thanks for the sensible critique. Me and my neighbor were just preparing to do a little research about this. We got a grab a book from our area library but I think I learned more clear from this post. I'm very glad to see such fantastic information being shared freely out there.

weed for sale

This is really interesting, You're a very skilled blogger. I have joined your rss feed and look forward to seeking more of your magnificent post. Also, I've shared your website in my social networks!

Buy Hair Extensions online

wonderful points altogether, you just received a new reader. What might you suggest in regards to your put up that you just made some days in the past? Any sure?

Tape In haarverlängerungen kaufen

I cling on to listening to the news bulletin lecture about receiving boundless online grant applications so I have been looking around for the top site to get one. Could you advise me please, where could i get some?

why not check here

Wow! This blog looks exactly like my old one! It's on a entirely different topic but it has pretty much the same page layout and design. Great choice of colors!

prepaid debit card

We're a gaggle of volunteers and opening a new scheme in our community. Your site provided us with helpful information to work on. You've performed an impressive task and our entire neighborhood will likely be grateful to you.

grolyrtolemcs

I think this is among the most significant information for me. And i'm glad reading your article. But should remark on few general things, The website style is great, the articles is really nice : D. Good job, cheers

Winter Schilder

It’s really a nice and useful piece of info. I’m glad that you shared this useful information with us. Please keep us informed like this. Thanks for sharing.

this website

whoah this blog is magnificent i love reading your articles. Keep up the good work! You know, lots of people are hunting around for this information, you could help them greatly.

read this

Thanks for some other magnificent article. The place else may anyone get that type of information in such a perfect method of writing? I have a presentation next week, and I'm at the search for such information.

blog link

This website is my intake, rattling superb layout and perfect articles.

extra resources

After all, what a great site and informative posts, I will upload inbound link – bookmark this web site? Regards, Reader.

waffentraining

Hi there! I know this is kinda off topic but I was wondering which blog platform are you using for this website? I'm getting tired of Wordpress because I've had problems with hackers and I'm looking at options for another platform. I would be great if you could point me in the direction of a good platform.

you can find out more

I believe you have noted some very interesting details, thanks for the post.

resources

It's a shame you don't have a donate button! I'd definitely donate to this superb blog! I guess for now i'll settle for book-marking and adding your RSS feed to my Google account. I look forward to fresh updates and will talk about this blog with my Facebook group. Talk soon!

his response

I would like to thnkx for the efforts you have put in writing this blog. I am hoping the same high-grade blog post from you in the upcoming as well. In fact your creative writing abilities has inspired me to get my own blog now. Really the blogging is spreading its wings quickly. Your write up is a good example of it.

exotic cars for sale near me

Hello! I could have sworn I’ve been to this blog before but after browsing through some of the post I realized it’s new to me. Anyways, I’m definitely happy I found it and I’ll be book-marking and checking back frequently!

best supplements for muscle growth

I am not rattling good with English but I line up this really easygoing to translate.

pop over to these guys

Its like you learn my thoughts! You seem to know a lot approximately this, like you wrote the guide in it or something. I feel that you could do with a few p.c. to power the message home a bit, however other than that, that is wonderful blog. An excellent read. I'll definitely be back.

discover this

hi!,I like your writing so a lot! share we keep in touch more about your article on AOL? I require a specialist in this area to solve my problem. Maybe that is you! Taking a look forward to peer you.

you could try this out

You have observed very interesting points! ps nice website . "He that will not sail till all dangers are over must never put to sea." by Thomas Fuller.

waterproof membrane for roof

I believe you have noted some very interesting details , thanks for the post.

you could look here

I was very pleased to find this web-site.I wanted to thanks for your time for this wonderful read!! I definitely enjoying every little bit of it and I have you bookmarked to check out new stuff you blog post.

pages

Hello would you mind stating which blog platform you're working with? I'm looking to start my own blog in the near future but I'm having a hard time deciding between BlogEngine/Wordpress/B2evolution and Drupal. The reason I ask is because your design and style seems different then most blogs and I'm looking for something unique. P.S My apologies for getting off-topic but I had to ask!

token game online

Hi my friend! I want to say that this article is amazing, nice written and include approximately all vital infos. I¦d like to look extra posts like this .

Buy passports

Unquestionably believe that which you stated. Your favorite justification appeared to be on the internet the easiest thing to be aware of. I say to you, I certainly get annoyed while people think about worries that they just do not know about. You managed to hit the nail upon the top and defined out the whole thing without having side-effects , people could take a signal. Will likely be back to get more. Thanks

porno

The best man is often the grooms most trustworthy and faithful friend or relative. Melony Olivero Goeger

כמה עולה לעשות צוואה אצל עורך דין

Hey there! I've been reading your blog for some time now and finally got the courage to go ahead and give you a shout out from Houston Tx! Just wanted to tell you keep up the excellent job!

speed up wordpress website

I do enjoy the manner in which you have framed this difficulty and it does present us some fodder for thought. Nevertheless, through what precisely I have experienced, I only hope as the actual opinions pack on that men and women stay on point and in no way get started on a soap box regarding the news du jour. Yet, thank you for this outstanding piece and even though I do not necessarily concur with this in totality, I respect the perspective.

dublaj

Love you BB. God Bless you as you share your amazing work and the love of our Lord. You are talented beyond measure! Gerti Laurence Urbai

filmkovasi

I am absolutely in love with the fall colors in this shoot. They add even more warmth and emotion to the pictures. Love these shots, love the couple even more! Wynny Reinald Theron

movie download

It is almost always triggered by a type of medicine that makes you sleep general anesthetic and is inhaled, or it is triggered by a medicine that relaxes your muscles muscle relaxant. Arlina Bil Kesia

tek parca

Excellent post! We will be linking to this great article on our site. Keep up the good writing. Ellynn Wolfgang Hapte

yabanci

Hi there, its good post about media print, we all know media is a fantastic source of data. Issie Dagny Ulphia Marya Ian Amadis

anime

#musculation #bodyfitness #pertedepoids #renforcementmusculaire #perdredupoids #bodyweightexercises #coachsportif #depassementdesoi #salledesport #musculationfrance #musculationfemme #seche #fitfrenchie #cardioboxing #repriseenmain #kilosentrop #lesecretdupoids #objectifpertedepoids Camellia William Ladew

diziler

I am usually to blogging we really appreciate your website content continuously. This content has truly peaks my interest. Let me bookmark your site and maintain checking achievable data. Malvina Brewster Lidda

dublaj

Very nice blog post. I certainly appreciate this site. Continue the good work! Danni Ruy Charline

online

Wow, great blog article. Really thank you! Really Great. Olenka Marcellus Marybella

hindi movie

Simply wanna say that this is very helpful , Thanks for taking your time to write this. Ronnie Garth Jankey

yabanci

Loved living in Comanche! Great little town! Wish we had stayed! Livia Moise Joye

720p

hello!,I really like your writing very much! percentage we keep up a correspondence extra about your post on AOL? I require a specialist on this space to resolve my problem. Maybe that is you! Looking ahead to peer you. Uta Sigismundo Gunilla

dublaj

Thanks a lot for sharing this with all folks you really know what you are speaking approximately! Sibyl Jess Laundes

erotik

The simplicity as well as the unique architectural beauty of Ayutthaya Province. Dory Zacharias Karine

turkce

Hi there mates, how is all, and what you desire to say on the topic of this article, in my view its truly remarkable designed for me. Reyna Sterling Patti

indirmeden

You have brought up a very great details , thanks for the post. Kristyn Valentin Bobinette

erotik

Awesome post. I am a normal visitor of your blog and appreciate you taking the time to maintain the nice site. I will be a regular visitor for a really long time. Corrie Dexter Brana

indirmeden

Amazing! Its truly remarkable post, I have got much clear idea regarding from this paragraph. Cosette Welch Agle

dig this

I¦ve learn a few good stuff here. Definitely worth bookmarking for revisiting. I wonder how a lot attempt you place to make one of these great informative web site.

erotik

We do sell hibiscus trees, they should arrive towards the middle of April. Johnath Jamaal Merete

erotik

Thank you for the sensible critique. Me and my neighbor were just preparing to do a little research about this. We got a grab a book from our local library but I think I learned more clear from this post. I am very glad to see such excellent information being shared freely out there. Mabel Barthel Cathie

erotik

Good info. Lucky me I reach on your website by accident, I bookmarked it. Berni Nilson Unity

turkce

The deck out encypher is symbolic of a deeper cultural modification at pecuniary firms, which are tiring to earmark up themselves as continuous hubs where individuality and theodi.dicy.nl/voor-vrouwen/groothandel-babykleertjes.php autonomy are emphasized. Goldman, which says one-quarter of its employees stand in engineering-related roles, has in-house incubator to let employees to happen ideas. He has plans to yawning a monetary technology campus. Olimpia Jimmy McGee

turkce

Your style is unique in comparison to other people I have read stuff from. Janene Denney Bille

hop over to this website

You got a very great website, Gladiolus I found it through yahoo.

network installation

Just wanna remark on few general things, The website style and design is perfect, the written content is very superb : D.

telefone e 0800

Great post, I believe blog owners should larn a lot from this web blog its really user friendly.

rinse kit australia

I dugg some of you post as I cerebrated they were very helpful very beneficial

real estate investment loans

I have not checked in here for a while as I thought it was getting boring, but the last several posts are good quality so I guess I'll add you back to my everyday bloglist. You deserve it my friend :)

hair salons near me

It's in point of fact a nice and useful piece of information. I'm satisfied that you simply shared this useful info with us. Please stay us up to date like this. Thank you for sharing.

Foster care

Yay google is my king assisted me to find this outstanding website ! .

elementor wordpress

Sweet blog! I found it while browsing on Yahoo News. Do you have any tips on how to get listed in Yahoo News? I've been trying for a while but I never seem to get there! Appreciate it

page

What’s Happening i'm new to this, I stumbled upon this I have found It positively useful and it has aided me out loads. I hope to contribute & aid other users like its helped me. Good job.

elementor pro tutorial

I have learn several just right stuff here. Definitely worth bookmarking for revisiting. I wonder how a lot attempt you put to create this sort of fantastic informative web site.

build blog

I think other website proprietors should take this site as an model, very clean and wonderful user genial layout.

stornobrzinol

Hello, I think your blog might be having browser compatibility issues. When I look at your blog in Firefox, it looks fine but when opening in Internet Explorer, it has some overlapping. I just wanted to give you a quick heads up! Other then that, amazing blog!

elementor pro 2021

I have not checked in here for some time as I thought it was getting boring, but the last few posts are good quality so I guess I'll add you back to my everyday bloglist. You deserve it my friend :)

how to make a website for beginners

I am always browsing online for posts that can help me. Thanks!

recommended reading

Really enjoyed this post, how can I make is so that I get an update sent in an email when you write a fresh article?

SW Smiles Dental Implants

Woh I like your articles, saved to favorites! .

how to use elementor

Greetings! Quick question that's totally off topic. Do you know how to make your site mobile friendly? My site looks weird when viewing from my apple iphone. I'm trying to find a template or plugin that might be able to resolve this issue. If you have any suggestions, please share. Thanks!

elementor page builder

Excellent web site. A lot of useful info here. I am sending it to a few friends ans additionally sharing in delicious. And certainly, thank you in your effort!

tagass

I do not even understand how I stopped up right here, however I believed this submit used to be good. I don't know who you might be however definitely you're going to a well-known blogger if you happen to are not already ;) Cheers!

elementor wordpress 2021

I truly appreciate this post. I’ve been looking everywhere for this! Thank goodness I found it on Bing. You've made my day! Thx again

browse around this website

I have been browsing on-line more than three hours lately, but I never found any attention-grabbing article like yours. It is lovely worth enough for me. In my view, if all webmasters and bloggers made good content as you did, the web will probably be a lot more useful than ever before.

Delta Air lines Fort Worth booking customer service

control of pest Fort Worth service https://www.craftstorming.com/?s=control+of+pest+%E2%98%8E+1%28844%299484793+Fort Worth+service+phone+number

Delta Air lines San Diego booking customer service

control of pest San Diego service https://www.webdesignerdepot.com/?s=control+of+pest+%E2%98%8E+1%28844%299484793+San Diego+service+phone+number

Delta airlines phone number

Веном 2 - смотреть онлайн в хорошем качестве https://bit.ly/venom2-2021

buy anabolic online

Веном 2 - смотреть онлайн в хорошем качестве https://bit.ly/venom2-2021

נערות ליווי

אני מאוד ממליץ על אתר ישראל נייט קלאב אתר מספר אחד בישראל לחיפוש נערות ליווי, דירות דיסקרטיות,עיסוי אירוטי כנסו עכשיו ותראו לבד כמה מידע יש באתר הזה: נערות ליווי בחיפה

david hoffmeister

Hello, i read your blog occasionally and i own a similar one and i was just curious if you get a lot of spam comments? If so how do you protect against it, any plugin or anything you can advise? I get so much lately it's driving me insane so any assistance is very much appreciated.

262504

938401

506499

507750

387201

125908

258180

203162

646286

796430

975156

776715

brain health supplements

Great line up. We will be linking to this great article on our site. Keep up the good writing.

https://europa-road.eu/hu/konteneres-szallitmanyozas.php

I really like your writing style, good info , appreciate it for putting up : D.

185735

821438

589499

381608

4rh5o0gt1x

710748

552917

901660

832587

236528

861538

232262

560930

831403

862902

665007

765634

598128

906459

787853

405958

415387

819795

115208

345596

398957

973556

651464

zomeno feridov

whoah this blog is fantastic i really like reading your posts. Keep up the great paintings! You understand, many people are looking round for this information, you could help them greatly.

how to hire a hacker

Those are yours alright! . We at least need to get these people stealing images to start blogging! They probably just did a image search and grabbed them. They look good though!

zorivareworilon

I got what you intend,saved to bookmarks, very decent site.

ringtone download mp3

This is so insightful!

דירות דיסקרטיות נתניה

Right here is the perfect site for everyone who wants to find out about this topic. You realize so much its almost hard to argue with you (not that I really will need toÖHaHa). You definitely put a brand new spin on a topic which has been written about for decades. Great stuff, just wonderful!

דירות דיסקרטיות בחולון - israel night club

I need to to thank you for this very good read!! I certainly loved every little bit of it. I have you book-marked to check out new things you postÖ

https://zapoznanstva18.com

תושבי ירושלים וסביבתה אשר מעוניינים להתמקצע בעולם הרפואה המשלימה, יכולים ללמוד בקורס רפלקסולוגיה ולרכוש כלים בגישה מבוקשת. את זה הם יכולים לעשות בעזרתן של נערות ליווי, אשר מתגלות לפעמים כמצילות נישואין. אם אתה מול המחשב קורא את המילים האלה, אתה בטח חרמן אש או סתם מרגיש בודד ובא לך בילוי איכותי ומיני. בפורטל סקס אש תוכלו למצוא דירה דיסקרטית בבאר שבע בשיא הפשטות, ולהנות מאירוח דיסקרטי, מענג ומשחרר. דירות דיסקרטיות בבאר שבע פופולריות יותר מכל עיר אחרת באזור הדרום. נערות ליווי דרום - כשהכול מתנקז לנקודה אחת זה יכול להיות פשוט ובעיקר להיות בדיוק מה שאתם צריכים ורוצים, תארו לעצמכם מקום שבו כל הטוב מתנקז לנקודה אחת, גם באזור שלכם, גם כל השירותים יחד והכי חשוב? כן, נכון להיום יותר ויותר אנשים כבר מבינים, עם נערות ליווי אפשר לעשות הכול מהכול מבלי לתת דין וחשבון לאף אחד והכי חשוב? מרכז אונו למשפט חברתי קליני הוא מרכז התנדבותי, בו עורכי דין מובילים בליווי סטודנטים למשפטים בקריה האקדמית אונו מעניקים סיוע משפטי לאוכלוסיות חלשות, למטרות חברתיות או לגופים ציבוריים.

נערות ליווי בתל אביב

נערות ליווי בלונדיניות, חלומית שתגיע אליך לתל אביב? כאן תמצא נערות ליווי שיגיעו אליך בהתראה קצרה ויגשימו את כל הפנטזיות הרטובות שלך. שירותי ליווי פרטיים ויוקרתיים מחכים לכם ממש כאן. כאן תמצאו הכל, קופונים, עסקים, יד2, רכב, נדלן, פרויקטי בנייה, דרושים, בעלי מקצוע, מכירות מעסקים פרטיים ועוד. בארץ וגם בארצות אחרות קיימות מרפאות לעזרה אלטרנטיבית וקונוונציאונלית לאישה, לילד, לקשיש, אך לא בכל מקום תמצאו מרפאה אשר עוזר למנוע בעיות גוף ונפש של גברים. בעלת מעבדת תיקון שעונים - האחריות לשעונים ניתנת בחנות וזאת כדי למנוע מהלקוח טרטור במעבדות היבואנים. בסנטר פרינטר ישנן מעבדת שירות למדפסות ומעבדת שירות למכונות צילום. בחברת סנטר פרינטר מלבד קניית מדפסות, מדפסות צבע, טונרים ומכונות צילום. גלעד הפקות היא חברה המתמחה בשירותי צילום לאירועים. רשת מחסני הדלת הינה חברה לעיצוב ושיווק דלתות בטחון , עם מבחר דלתות מעוצבות ממיטב המותגים המובילים בענף הדלתות. אניגמה הינה חברה המתמחה בהפקות ימי כיף לעובדים, כנסים ואירועים ומציעה את כל השירותים הנלווים הרלוונטים להפקת יום מושלם. חברת וירטואל פוינט הינה החברה המובילה בישראל בהפקת אנימציות, סרטי תדמית וסרטי הדרכה רפואיים. י אדריכלים ומהנדסים מן השורה הראשונה צוות עובדי החברה הינו צוות קבוע והחברה אינה מעסיקה קבלני-משנה. שר"פ תל השומר הינו מרכז רפואי פרטי, שנמצא בסמוך למרכז הרפואי שיבא. בשר"פ תל השומר עובדים צוות המקצועי והמיומן ביותר של רופאי שיבא, ממרבית מקצועות הרפואה הקיימים.

best cryptocurrency to invest

Wonderful blog! Do you have any recommendations for aspiring writers? I'm hoping to start my own blog soon but I'm a little lost on everything. Would you suggest starting with a free platform like Wordpress or go for a paid option? There are so many choices out there that I'm completely overwhelmed .. Any tips? Bless you!

what is the best cryptocurrency to invest in

hello!,I like your writing very much! share we communicate more about your post on AOL? I require an expert on this area to solve my problem. May be that's you! Looking forward to see you.

dr. Jáger Krisztina ügyvéd

Great post, I conceive blog owners should larn a lot from this site its really user genial.

דירות דיסקרטיות בחיפה

וכך, בעשור האחרון התפתחה לה נישה חדשה בעולם העיצוב - קליניקות ומרפאות ייחודיות, הנשענות על עוגנים פסיכולוגיים, חברתיים וטיפוליים, מעבר להיבטים האדריכליים והתכנוניים. קליניקות מאובזרות, מרווחות ומוארות במיוחד. או מגע מלטף ועדין שיעניק לכם תחושה מרגיעה? עם זאת, ישנם עיסויים במרכז המתבצעים כעיסויים "יבשים" - כאלו המבוססים אך ורק על מגע המעסה. מסאג מפנק עם צעירה שובבה, לשעות ללא מעצורים. אם אתה מחפש נערת ליווי 18xil הוא המקום להתחיל את החיפוש אחר עיסוי מפנק. בדומה למה שאתם בודאי מכירים מטיפולי ספא בחיפה והסביבה אחרים (כמו עיסוי שוודי קלאסי / עיסוי באבנים חמות / עיסוי ארומטי ועוד), גם בטיפול רפואי, יהיה גוף המטופל מכוסה כמעט כולו במגבת או סדין, והמטפל יחשוף כל פעם אזור אחר בגופו של המטופל, הרלוונטי לאותו שלב בטיפול. עיסוי קלאסי בחדרה באזורים, תשומת לב רבה יותר מוקדשת לחלקים מסוימים בגוף (למשל ישבן, גב, אזור צווארון). ביקור במקום לפני הטיפול: אם אתם רוצים להיות בטוחים במאה אחוז בתמצאו מקום שעושה עיסוי ארוטי בראש העין שעונה על הדרישות שלכם, אנו ממליצים להתחיל בשיחת טלפון ולשאול על טיפולי העיסוי, על ההסמכות של המטפלים ומה הם בעצם מציעים. מדובר על מעין "כרטיסיית עיסויים בראש העין!" שאתם רוכשים מראש, כך שתוכלו לקבוע עם המעסה מפעם לפעם בהתאם ללוח הזמנים שלכם ולצרכים שלכם.

נערות ליווי בתל אביב tkescorts.com

ישנם אנשים שמקבלים עיסויים למטרות פינוק וכייף בביתם ולפעמים מגיעים לדירה דיסקרטית בבאר שבע אך גם ישנם אנשים המבקשים לעבור עיסוי בדרום בעקבות כאב מסוים. על מנת שתוכלו ליהנות משלווה ורוגע ומבלי שתצטרכו לחוש בחוסר נוחות בעקבות ההוצאה, הגדירו מראש כמה תרצו להשקיע בעיסוי. דירות דיסקרטיות באשדוד מציעות את התנאים הדרושים על מנת שתוכלו לבלות בנעימים עם בת הזוג, המאהבת או כל פרטנר שתבחרו בו. המעסה יעבוד על פי הטכניקות שלמד ובסדר הטיפול שהוא מאמין בו (גב, רגליים, כתפיים, ידיים וכו’) ובהתאם לבקשות המטופל כמובן והתחשבות גם במצבים בריאותיים מסוימים (כמו פריקת כתף למשל העשויה להגביל חלק מתנועות הגוף במהלך העיסוי). על פי הרפואה הסינית, ישנו קשר ישיר בין הגוף והנפש, והעיסוי הזה שם את הדגש על השידוך ההרמוני ביניהם. ניקוי רעלים - הגירוי שנוצר על ידי העיסוי מסייע לזרימה הלימפטית ומעודד בריאות גופנית ורמות אנרגיה גבוהות יותר. עיסוי הרקמות מתאים לאלו מכם המעוניינים להגיע להרפייה - גופנית ומנטלית עם שחרור השרירים. עיסוי אירוודה בחדרה מתאים מאוד למי המחפש עיסוי מפנק במיוחד. העיסוי באבנים חמות מתאים מצד אחד לאנשים עדינים ורזים ומצד שני לאנשים מסיבים בעלי שרירים גדולים ומפותחים . העיסוי באבנים חמות משמש גם כטיפול וגם כפינוק , יתרון גדול יש לאבנים חמות שניתן לשים אותם על העצמות ובמיוחד בעמ״ש ע״י החום אפשר לטפל בכאבים באצמות מה שלא ניתן לעשות בעיסוי .

שירותי ליווי באילת

מתאימים לכל סוגי האירוח שתחפצו - מסיבת רווקים ורווקות, יום כיף מפנק, יום אהבה, או כל אירוע חגיגי שיש בו שמחה אנחנו מחכים לכם בכל יום ובכל שעה ביום, שירות דיסקרטי לחלוטין. עם חבילת מאסז עד הבית תל אביב תוכלו לבחור בסוג העיסוי המועדף עליכם מבין שלל סוגי טיפולים ועיסויים שהצוות המקצועי שלנו אמון על ביצועם. אתם מתעניינים לגבי עיסוי בתל אביב וגם לגבי עיסויים במקומות שונים בארץ? במסגרת מאמר זה נסקור את מגוון דרכי הטיפול הנכנסות תחת הקטגוריה הרחבה של עיסויים רפואיים, את מהלך הטיפול בעיסוי רפואי, סוגי הבעיות להן מסאג' מפנק יכול לתת מענה ונסביר גם למה ניתן לצפות כאשר עוברים טיפול של עיסוי קליני. מיתוסים על עיסויים שהגיע הזמן לנפץ! כל המידע בסקס אדיר מאומת על כל המשתמע מכך, כן, זה לא מקרי, הפורטל עובד קשה בכדי למצוא ולהביא לכם מודעות מאומתות בכל התחומים. בפורטל הבית שלנו כל התמונות והמודעות מאומתות וכך מאפשרות לכם להשיג את הבילוי המושלם ביותר עלי האדמות. באמצעות פורטל הבית שלנו תאפשרו לעצמכם לעשות את הבחירות הטובות והנכונות ביותר- הבחירות של פעם אחת בחיים, בחירות מאומתות לצד תמונה ומידע אמין יותר מהרגיל. דירות דיסקרטיות בראשון לציון - איך מוצאים את הטובות ביותר?

שירותי ליווי

כך שלא משנה אם אתם מחפשים חדרים לפי שעה בירושלים, או מעדיפים דווקא חדרים לפי שעה בבאר שבע, כאן תוכלו לקבל את כל הפרטים לגבי האפשרויות השונות המוצעות לכם באותו העיר או האזור. חדרים לפי שעה הם הפתרון המושלם עבור אנשים המחפשים פיתרון זמין וזול יחסית ללינה של מספר שעות. לא משנה מהי הסיבה בגינה אתם מחפשים חדרים לפי שעה, ישנם מספר פרמטרים אשר יסייעו לכם לבצע את הבחירה הנכונה. בסופו של דבר, אתם רק צריכים להחליט באיזה סוג של חדרים אתם מעוניינים ולמצוא בקלות חדרים אשר יענו על מבוקשכם. גם הם יוכלו למצוא בקלות יחסית בדיוק את מה שהם מחפשים. לשם השוואה, בבתי המלון או במקומות האירוח הקלאסיים שכולנו מכירים, קיימת דרישה לשלם עבור אירוח של לילה שלם, גם אם מחליטים לעזוב את המקום רק אחרי שעתיים. כמובן, שאם קבלתם המלצה על על מקום מסוים, ובא לכם להתפנק או להתארח במשך שעה, שעתיים או כמה זמן שאתם יכולים במקום אשר עומד בסטנדרטים הגבוהים ביותר האפשריים, תוכלו ליהנות כמובן, ממענה איכותי על מבוקשכם. אם יש לכם דרישות ספציפיות, או שאתם חוגגים אירוע מסוים ורוצים ליהנות מתפאורה מתאימה תוכלו כמובן ליצור קשר עם החדרים שנראים לכם שעומדים בסטנדרטים שלכם. במקרים רבים, המתארחים באותו חדר לפי שעה כלל לא נדרשים או צריכים להיפגש עם עובדי המתחם.

שירותי ליווי

למה עליכם לצפות מעיסוי עד הבית בתל אביב? למה לא ללכת לקליניקה לעיסוי בהרצליה? למה אנשים בוחרים בעיסוי ואיך הוא יכול לשנות את חייהם לא רק בהיבט הפיזי אלא גם בהיבט הנפשי והמנטלי? בכוחו של מגע המעסה לשנות מצבים רגשיים וגופניים, ולגרום להטבה משמעותית בתחושה … בניגוד לעיסוי בריאות, כל תנועות המעסה חלקות, איטיות: עיסוי מפנק בבאר שבע הוא ליטוף, לישה קלה. אם כבר עשיתן או עשיתם את הכל ואתם לא מצליחים לרדת במשקל לא תאמינו עד כמה עיסוי אחד יכול לשחרר את כל הקשיים ולסייע לכם להגיע למשקל שלא הייתם/ הייתן בו שנים. עיסוי שוודי הוליסטי בחדרה כבר אלפי שנים אמונות שונות מצביעות על איחוד סינרגי בין הגוף והנפש. עיסוי פרטי בקרית שמונה/נהריה הוא דרך נפלאה לשחרר את הגוף והנפש בסביבה הפרטית, המוכרת והרגועה שלנו. מי שמחפש עיסויים מפנקים בקרית שמונה המשלבים פינוק וייחודיות ללא ספק צריך לבחור או לפחות לנסות פעם אחת עיסוי אבנים חמות. אילו סוגי עיסויים אפשר להזמין ומה צריך להכין לקראת האירוע? העיסוי מקדם תחושות של שלווה ורגיעה לקראת היום הגדול, ומסייע להקל משמעותית על כאבי גב תחתון וקרסוליים נפוחים.

שירותי ליווי

קליניקה לעיסוי מקצועי ואיכותי בהרצליה. עד היום היה לכם קל לתרץ את העובדה כי אתם לא מפנים זמן לעיסוי רק מאחר ואתם עובדים מאד קשה? ישנם לקוחות רבים שמבקרים בדירה דיסקרטית בחיפה בשביל הבלוי אנחנו , מבטיחים כי לנערות יש חוש הומור מפותח ואופי מדהים שלא תרצו לעזוב . שתי ילדות יפות - אחד אירופים ואחד ישראלי, יש טיפול מיוחד עבור הגוף. איך היא מניעה את הגוף שלה בשבילך? מטרתנו שתמצא את העיסוי הרטוב שלך . לכן העיסוי במרכז שלנו מבוצע על ידי מומחים מקצועיים בעלי תעודה המעניקה את הזכות לעסוק בפעילות מסוג זה. זהו הזמן לעצור ולהירגע ולהתחיל לחשוב על הבילויים שלכם. בשורה התחתונה, בזכות האינטרנט, ניתן לגלות שיש לא מעט נערות ליווי בחיפה והסביבה ומכיוון שהיצע האפשרויות הינו רחב, כל אחד יוכל לבחור מתוך האפשרויות את אותה נערת ליווי אשר תענה על מלוא דרישותיו וצרכיו - כך שלצד המיקום הגיאוגרפי, כדאי להכניס פרמטרים נוספים אשר יכולים להיות בעלי חשיבות והשפעה על הבחירה כמו: עלות השירות, זמינות ונתונים שונים אשר נוגעים לבחורה עצמה. זה גורם לכל החוויה להיות אפילו עוד יותר מרגשת וכך אתם יכולים להיות בטוחים שיש תמורה מושלמת להשקעה שלכם ושאתם עומדים לממש את הפנטזיות שלכם עם אישה יפהפייה, מושכת ומנוסה.

נערות ליווי

כמו כן, בראשון לציון יש דיי מבחר גדול לחדרים פנויים ושל בתי מלון. הספא הפועל במקום הנו מבין המקצועיים ביותר באזור, המציע למבקרים מבחר חבילות ספא משולבות הכוללות שפע פינוקים ותענוגות ספא שלא תשכחו. דרך מומלצת במיוחד ליהנות מהחוויה המרתקת ששמה עיסוי טנטרי היא לעבור אותה בזוג, בפרט במסגרת יום ספא זוגי שכולו פינוקים לפני העיסוי ואחריו. בכל פעם הם חושבים שהם מקבלים פינוקים מהחברה תמורת בזבוז זמן היקר. הם יכולים להזמין עיסוי אירוטי באשקלון בבית פרטי, בבית מלון, בדירות דיסקרטיות או בחדרים לפי שעה. אילו שירותים מספקות נערות ליווי באשקלון? איך מזמינים נערות ליווי באשקלון? איפה עושים עיסוי שוודי באשקלון בצעו חיפוש גיאוגרפי, והציגו תוצאות על גבי מפה: אחד היתרונות של חיפוש גיאוגרפי, הוא היכולת למצוא מישהו שקל ונח יהיה להגיע אליו, בין אם אתם … עיסוי במרכז עד הבית או עיסוי במרכז בקליניקה פרטית וזכרו הבחירה היא תמיד שלכם. אבל גם אנשים הסובלים ממתח נפשי מסיבות שונות ואפיו חולים במחלות קשות יכולים ליהנות מהיתרונות הרבים של עיסוי עד הבית בכפר סבא, רעננה והסביבה. המלון מתאפיין בסגנון ייחודי המשלב בין אווירת העיר האורבנית והתוססת, לבין אווירת שלווה ונופש קסומה, כך נוצרת סביבת שהות אופטימלית לאורחי המקום, אשר יכולים ליהנות מכל העולמות במתחם אחד מיוחד במינו.

ליווי באילת

אין דבר יותר טוב מלהיות מפונק בעיסוי מקצועי ברמה הגבוהה ביותר? המעסה המקצועי בקרית שמונה/נהריה מטעם המכון יגיע עד אליכם עם מיטת מסאז’ נפתחת, שמנים וכל הציוד הנדרש לביצוע המסאז’ ברמה הגבוהה ביותר גם בתנאי שטח או בתוך בית. זה עיסוי הוליסטי ולא נועד למקרים בהם אתם עם שרירים תפוסים או מעוניינים בעיסוי הכולל לחיצות חזקות בגוף. לרוב, עיסוי מפנק בירושלים או בכל אזור אחר בארץ, אורך כשעה, כך שבשעה זו, עליכם להתמקד בהנאה שלכם ובגוף שמתחיל לתת את הסימנים שטוב לו שהוא נרגע והמתח בשרירים ייעלם כלעומת שבא. זוהי עובדה ידועה ולכן, זוגות באים לקבל טיפול של עיסוי מפנק בצפון , או בכל אזור אחר בארץ תוכלו לבחור את המעסה על פי האזור שבו אתם גרים. אפשר להזמין מבעל המקום את השירות האלו לתוך דירה דיסקרטית מבלי לחשוש ולבלות מספר שעות של מסיבת רווקים מתהוללת ושמחה ולחזור יום אחר כך לשגרה הרגילה והמוכרת. בדירות יש שירותים ומקלחת מפנקים, מיטה שכיף לנוח בה, מקרר עם אלכוהול ומטבחון וניתן להזמין לדירה אוכל. המטפלים מגיעים עם מיטות טיפול מקצועיות וכל הציוד הדרוש לעיסוי מקצועי ומשובח. טיפול להפגת מתחים, להמרצת מחזור הדם, לרוגע ופינוק. העיסוי המקצועי בקרית שמונה/נהריה תפס מקום רב בתחום הרפואה המשלימה וידוע כבר לאורך דורות רבים כשיטת טיפול יעילה גם עבור ספורטאים וגם עבור אנשים אחרים.

שירותי ליווי באילת

ישנן עשרות טכניקות של עיסוי המוצעות בישראל ללקוחות, כאשר הרבה מהן דומות אחת לשנייה אך כמה מהן שונות בקונספט ובסגנון ולעתים גם בעוצמת העיסוי. מסיבות רווקים/רווקות, ימי הולדת, אירועי חברה ולעתים אפילו חתונות - הם רק חלק מהאירועים שיכולים להזמין שירותי עיסוי פרטי על ידי מעסים מקצועיים. יצירת קשר עם המעסה או הקליניקה לא היתה פשוטה כלכך מעולם, פשוט מאוד נכנסים ובוחרים את איזור הטיפול המועדף עליכם, ושם יחכו לכם מעל ל2500 מעסים ומעסות בכל התחומים לבחירתכם עם כל הפרטים והמחירים . כמו כן אפשר למצוא בכרטיס האישי של כל נערה את הפרטים על הנערה ועל השירותים שהיא מעניקה. בין יתר מתחמי הבילוי התוססים על העיר ירושלים תוכלו למצוא את מתחם מדרחוב בן יהודה הכולל גם את שוק מחנה יהודה ההופך החל משעות הערב למוקד בילוי לילי שוקק חיים, רחוב נחלת שבעה, אזור התעשייה תלפיות, מתחם המושבה הגרמנית, מתחם קניון מלחה, מתחם שדרות ממילא, וכמובן אזור הבילויים המרכזי של העיר המשלב בתוכו כיום גם את רחוב שלומציון המלכה והרחובות הסמוכים.

ליווי באילת

ישנם מעסים שלא מעסים בעירום ואינם מאמינים בחשיבות העירום גם מצידו של המטופל. בעיסוי אינטימי זה, הנעשה בעירום עם שמנים, אתה לומד לחוות עונג מסוג אחר, להכיר את גופך בעוד דרך. עיסוי טנטרי מעורר ביטויי עונג מבוקרים והרפיית שרירים, התואמים את הפילוסופיה המסורתית. עיסוי לינגאם, זה עיסוי שהוא חוויה שלמה של הגוף והנפש, מתנה ענקית עבור עצמך למיניות מעצימה מרפא ושלמה עם עצמך. מתנה גדולה עבור עצמך. זאת מתנה גדולה שהתגלתה והפכה נפוצה יותר בתקופה שלנו אנו וזאת מתנה וזכות גדולה בחקירה והעמקה שלנו עם המיניות המעצימה והבריאה. העיסוי מתחיל בשיחה כנה ופתוחה על עולמך המיני, על היחסים שלך עם הלינגאם, על ההיסטוריה הבריאותית, על הקשיחות, על גמירה, עונג, כאבים. הטיפול מתחיל בניקוי וקילוף יסודי של העור באמצעות אדי חום או תכשירי "פילינג". עיסוי טנטרה נחשב לאחד העיסויים היקרים ביותר, כך שאם אתם מראש מתכננים לקבל מספר עיסויים, יהיה כדאי לרכוש אותם בחבילה מרוכזת שתעניק לכם הנחה שיכולה להיות מאד משמעותית. נלמד מספר כלים ושיטות להגברת העונג, העמקת האינטימיות, הגברת המודעות, הזרמת האנרגיה המינית בגוף והעברת הילינג דרך כפות הידיים והלב. העיסוי הוא עיסוי לכל דבר ועניין, המתמקד באזורים שונים בגוף. כך לדוגמא, בעת שאתם מעוניינים לעבור עיסוי בבת ים המתמקד אך ורק בראש, או לחילופין בעיסוי המתמקד באזור הכתפיים.

ליווי באילת

חברת "אוצר הספרים" מתמחה בשיווק והפצת ספרי קודש במחירים זולים ברחבי הארץ והעולם. במידה ואתם מחפשים דירות דיסקרטיות במחירים זולים בעיר חדרה, דעו לכם כי בעזרת המערכת של פורטל סקס אדיר תוכלו סוף סוף למצוא את מבוקשכם. מערכת חיסונית- עוזר בחיזוק המערכת החיסונית בגוף וחיזוק מערכת הלימפה. אתר יועצים ברשת עוזר לכם לבחור קורס פסיכומטרי מבין מגוון הקורסים הקיימים, בהתאם לתקציב ולצרכים שלכם. אין מדובר באתר דרושים כללי ה"יורה לכל הכיוונים", אלא על אתר מכוון אך ורק לתחומי המתכת, הפלסטיקה והגומי. סיגריה אלקטרונית סיגרלה - cigarella אתר מכירות וירטואלי מאובטח בתקן הגבוהה ביותר, חוויית הקנייה באתר מאפשרת לך לרכוש מוצרים מיבוא ישיר ישירות מהיצרן. אתר המדריכים של ישראל. אתר getcellnet, הוא האתר המוביל בישראל למכירת טאבלטים, טלפונים סלולרים, אביזרים לסלולר, גאדג'טים ועוד. האתר מכיל לוח טרמפים מקיף של נסיעות משותפות לכל הארץ, לאוניברסיטאות, לאירועים, לעבודה ולכל מקום. פיק אפ הוא לוח טרמפים שמאפשר לכם לפרסם נסיעות ולהצטרף לנסיעות שמשתמשים אחרים פרסמו על בסיס חברים משותפים בפייסבוק.

ליווי באילת

בחברת מוצרי פרסום לעסקים אנו מציעים מגוון רחב של מוצרי פרסום שבהם תוכלו להטביע את סמליל העסק וכך לקדם את המכירות שלכם ולצבור לקוחות פוטנציאלים. חברת "עידן חדש מוצרי פרסום ומתנות" עוסקת בפיתוח ושיווק מוצרי פרסום, מתנות לגים ולאירועים במגזר העסקי והפרטי. תוכלו לתת להם גימיקים למחשב, מתנות מיוחדות לעובדים, חולצות רקומות לטובת עסק. את הערב תוכלו לסיים בדירות דיסקרטיות בירושלים, הרי ברור שבני הזוג אוהבים לבלות יחדיו באינטימיות, אך לפעמים בבית אין פרטיות ולכן נוח מאוד לבלות בדירות דיסקרטיות, אבל לא תמיד ישבת זוג לכן בדירה הדיסקרטית ניתן לפגוש מעסות סקסיות אשר ינעימו את זמנכם בעיסוי מטריף חושים. לחילופין, אם אתה מעוניין בפרטיות ובדיסקרטיות, ניתן להזמין ליווי בחיפה גם לביתך או למלון, להזמין ולהינות בדירה דיסק. היצע דירות גדול - ישנו היצע גדול של דירות דיסקרטיות בחיפה. ולכן, בבאר שבע ניתן למצוא היצע מאוד גדול של דירות דיסקרטיות אשר מספקות עיסוי אירוטי ממשכנן. עיסויים בצפון אשר מתרכזים בעיסוי השוודי יאפשרו לכם הנאה מלאה ובילוי נהדר. עיסוי אירוטי בצפון הוא הרבה יותר ממפגש מיני סתמי או מעיסוי, מדובר כאן בחוויה ארוטית מלאה המועברת על מיטות רחבות, נעימות וגמישות תמונות אמיתיות של. אם ברצונכם בבחורה בלונדינית, שמנה, רזה, אתיופית או כל פנטזיה אחרת שמעניינת אתכם, בנתניה דירות דיסקרטיות והזמנת עיסוי מפנק אירוטי הוא לגמרי המקום הנכון לממש את הפנטזיות האלו.

נערות ליווי באילת

נערות ליווי בימינו מעניקות שירותים המהווים פתרון עבור גברים אשר עשויים להזדקק לשירות זה או אחר. אני מניח שאני לא צריך לספר לכם מה עושים עם נערות ליווי בחדר המיטות… מעכשיו ניתן לפלפל כל אירוע עסקי או פרטי שלכם עם עיסוי לבחירתכם. יש עיסויים ארוטיים בליווי שמנים ועוד מגוון סוגים לבחירתכם. זה הוא לא פורום של סוכנות או משרד ליווי בודד - זה אתר שמספק מגוון עצום של משרדי ליווי. משרד סקס עם תמונות אמיתיות לחלוטין. כמו כן, תמונות אמיתיות של נערות ליווי בכפר סבא. נערות ליווי בגבעתיים אז בגעתה למקום הנכנון שבו תקבלו את העיסוי הטוב ביותר שיסופקו לכם נערות הליווי מנוסות ומיומנות שלנו המגיעות עד לביתך מלון או חדר . באילו ימים כדאי להשתמש בשירות של מסאג' אירוטי בגבעתיים? האם בחוזה של הקליניקה להשכרה בשרון תיתכן גמישות בהשכרה הכוללים ימים ושעות? צריך לבדוק את הפרמטרים שיש מסביב, האם מדובר בעיסוי באזור רחובות או מחוצה לה? במקרים כאלו, כדאי לברר אל מול המעסה האם הוא מציע דיל של כמה עיסויים במרכז במחיר מיוחד. הגן הקסום בעיר העתיקה חדרים להשכרה לפי שעה בבאר שבע במחיר נוח, ברחוב טרומפלדור בעיר העתיקה - מקום קסום.

ליווי באילת

המוצעים לכם - מהשבדי, דרך השיאצו ועד עיסוי בבאר שבע הרקמות, אך גם לאחר שבחרתם את סוג העיסוי, תוכלו להנחות את המעסה באשר לעיסוי המתאים לכם ביותר. לסיכום, דירות דיסקרטיות מדגישות את היתרונות של בילוי רומנטי ואפשר להזמין אליהן נערות ליווי גם בלי שום סוג של הכנה מוקדמת. את מוציאה את הזין שלו מהפה שלך ונותנת לו נשיקות ונשיכות סקס דירות דיסקרטיות בירושלים זונות רכות על החיבור הזה, מאחורה, בין הזין שלו לכיפה של הזין שלו והוא מתפתל בהנאה. לכן, אם אתה אלרגי לרכיבים שונים, אז יש לספר על כך למומחה. במידה ותרצו לכלול גם כיבוד/ארוחה/תפאורה במקום יש לתאם זאת מראש מול משרדי הספא. ישנם אנשים שלא מרגישים בנוח שבן המין השני נוגע בהם, כך שחשוב לתאם מראש עם מכון העיסוי מפנק בהשרון והסביבה את מין המעסה. המעסה הזאת תגרום לך להרגיש חושים שעוד לא הרגשת,… זוהי עובדה ידועה ולכן, זוגות באים לקבל טיפול של עיסוי מפנק ברמת הגולן , או בכל אזור אחר בארץ תוכלו לבחור את המעסה על פי האזור שבו אתם גרים. מסאג' מפנק מפרטי ברמת גן. ממה מורכבת שיטת העיסוי מפנק?

ליווי באילת

לילי - הבלונדינית הסקסית עם תחת ענק! היא טבעית עם תחת מטורף ויפייפה. ויקטוריה בת 22 בלונדינים עם חזה סקסי וטבעי, היא עכשיו בנשר ויכולה להגיע עד אליך ולהעניק לך עיסוי - מסאג ברמה אחרת שעוד לא הכרתה עד היום. יהיה לך חם כשהיא תגיע עד אליך בנשר. נא להשאיר פרטים ונחזור אליך בהקדם! הבחורות אשר עובדות בליווי הן בחורות משכילות ונעימות אשר תמיד נחמד להעביר איתן את הזמן. כאן ועכשיו עפולה העיר המושלמת ביותר מציגה לכם דירות מדהימות עם אבזור מלא, אבזור חלקי, ג'קוזי מפנק, בישום, שמנים ואפילו מצעים נקיים להעביר את הלילה הבטוח והלוהט ביותר אליו אתם שואפים. אם תרצו תוכלו אפילו לצאת עם הבחורה לאחד המעודנים ולבלות בריקודים. הבחורה הזאת נערה צעירה על רמה והיא עכשיו בנשר! לנה בחורה על רמה! מישל בחורה מקסימה ומאוד יפה! תוכלו ליהנות מארוחה טובה, כוס משקה ושיחה עם בחורה מעניינת שלא פוגשים כל יום. האמת שיש לכם את כל הסיבות שבעולם מדוע לבלות עם נערות משירותי ליווי בלוד. אם עד היום הכול שקע ולא סיפק את תשובת התשובות הנה ההזדמנות הנהדרת למפגשים מהסוג האחר עם נערת ליווי שיודעת ומבינה מה אתם צריכים בדיוק ברגע זה. בזמן מגע לנו צוות מעסים מיומן ומקצועי אשר ישמח להגיע ישירות עד לבית שלכם ולבצע עיסוי זוגי.

נערות ליווי באילת

היום כבר לא צריך "לנדוד" מאתר לאתר כדי למצוא עיסוי מפנק בחיפה, קריות והסביבה ברמה גבוהה. עיסוי אירוטי ביהוד, עם אתה רוצה להיתפנק בעיסוי לוהט ביותר אז הגעת לאתר הנכון, כאן תקבל את השרות הכי מקצועי בארץ 24/7 ובכול רגע שרק תרצה. כך שאם מסיבה כלשהי אינכם יכולים לצאת מהבית או שאתם מעוניינים להכין הפתעה נעימה לבן משפחה אהוב, מעבר לכך, באתר תמצאו מטפלים מנוסים בלבד שיש להם 3 שנות ניסיון לפחות בעיסוי. אם תחשבו על זה, כל מה שאתם צריכים בכדי להתפנק בעיסוי הוא לפנות בלוח הזמנים שלכם שעה או שעתיים בלבד. מבין כל האנשים כל מה שאתם צריכים זה לבטוח בפורטל אחד שיספק לכם נשים וגברים שלא רק מעסים את המקום הכאוב אלא מביאים אתכם לשיאים של הנאה- רוצים לדעת איפה לחפש את זה? מצד שני, היום כבר לא צריכים לבזבז זמן וכסף: אפשר להשתמש בשירותי האתר ולהזמין נערות ליווי לביתך ולמלון בירושלים בהתראה מיידית. ובנוסף לכל זה, הגבר לא ממהר להקיש באצבע הקמיצה שלו, מאשר להיכנס לנערות ליווי בדיכאון שנמאס להן לחיות בנישואים אזרחיים. אין לעיסוי מטרה להביא את הגבר לשפיכה ולהנאה מינית.

נערות ליווי בתל אביב

אנשים רבים מגיעים לדירות עם כל סוגי הפרטנרים, מזוגות נשואים ועד בגידות, גייז ואפילו נערות ליווי חילופי זוגות. אנשי עסקים - ירושלים היא מרכז עסקים חשוב מאוד ואנשי עסקים מהארץ ומעולם מגיעים אל העיר. עיסוי מפנק במרכז בסגנון התיאלנדי יתאים מאוד למי שאין בעיה עם מגע מעט כואב ולמי שמעוניין בשחרור והרפיה מלאים. מאוד מפנקת עסיסית בחורה צעירה תתקשר אלי נמצאת ברמת גן . ג'ניפר צעירה ומלאה בתשוקות. רמת גן, עיר הנמצאת במרחק נסיעה קצרה מתל אביב, מהווה מוקד עלייה לרבים שרוצים לחוות מהחוויה התל אביבית ומצד שני ליהנות מחוויה אורבנית, שקטה ומלאה באטרקציות קולינריות וחיי לילה עשירים. עיסוי אירוטי בפתח תקווה מהווה דרך טובה לחגוג את יום ההולדת, לבלות בערב פנוי. עיסוי אירוטי בפתח תקווה במיטבו ישאיר אתכם עם זיכרון מתוק. כן, מסאז' אירוטי בפתח תקווה לא עם בחורה אחת אלא עם שתיים. בחורה מתוקה שתזכיר לך את אהבת נעורך, סשה היא נערת ליווי נשית עם אופי חם… בצפון יש אוכלוסיה ענקית ומגוונת מאוד, שלמרות שהיא נמוכה יותר מבחינה מספרית מזו במרכז, הביקוש לנערות ליווי בצפון הארץ גדול אפילו הרבה יותר!

נערות ליווי בתל אביב

מיקי בת 20 נערת ליווי חדשה באילת הזמנה לביתך… ג'וליאנה נערת ליווי VIP גבוהה שיער שחור ייצוגית לכל איש עסקים מגיע ליווי הולם, לפגישות או לבילוי וחברה ג'וליאנה היא הדבר הבא… זהו הבילוי המומלץ עבור תיירים או אנשים שמגיעים לתל אביב לפגישות עסקיות. בחורה סקסית מתל אביב מארחת לפינוק מטריף חושים עובדת רק בשעות הבוקר! אלונה היא בחורה שמיועדת לאנשים עם טעם מיוחד וספציפי מאוד. ברוכה הבאה לעולם האופנה התחתונה של "זינגר" זינגר הלבשה תחתונה, נוסדה לפני 60 שנה ואנו מתקדמים ומתפתחים עם עולם האופנה, בסלון זינגר תזכי תמיד לתחושה ביתית ויחס אישי. נפש- עיסוי תמיד יוביל לשחרור של שרירים והרפיה מלחצים. הגיע הזמן לפינוק אמיתי לשחרור רגשות, לעיסוי מפנק ובעצם למה לא אני בכלל מעדיף עיסוי עד הבית כן זו בעצם אופציה לא רעה להזמין עיסוי עד הבית גם להתפנק,גם לשחרר שרירים וגם להישאר בטרטוריה שלי . עיסוי שוודי קלאסי- כאשר מזמינים מסא'ג עד הבית עיסוי שוודי כטיפול מלא מהווה בחירה מצוינת אך לא לבדו אני מעדיף וממליץ לשלבו עם טיפול רפלקסולוגי ובשילוב מסאג באבנים חמות לקבלת הנאה מושלמת .עיסוי שוודי הוליסטי הינו עיסוי בינלאומי מוכר ,פופולארי,מצוי וידוע לכל כעיסוי מפנק ולכן יהווה בחירה מצוינת במסאג עד הבית . קליניקת רויכמן הינו מרכז טיפולי ייחודי, המתמחה בטיפולי רפלקסולוגיה וקינסולוגיה ובטכניקות טיפול נוספות.

465999

298670

465999

nhkv7uh3mt

985965

unr66gha5n

465323

q31dke3dmb

465999

ap5q2670hq

465999

298670uzzbj450jh

465999g8rww9ikru

298670

465999

298670

465999

8ajco420vvkcrjt5gb0k7hs8azgs4j1jpbhz9mzao

985965

hl6lzdd964vl2s4erkbtiq3hl8r1fseo2gu4mrcf1

465323

0z04dwrskn94gbix53pcw9h0zr5ktbu4iwak27svh

465999

ophs3khgabzs6z8lvrf0mx7opfv8jzlq9i16ttjh8

npgr3jhfaazr6y8kvqfzmw7npev7jylp9h15tskg9

298670

Content Generator

Artificial intelligence creates content for the site, no worse than a copywriter, you can also use it to write articles. 100% uniqueness :). Click Here:👉 https://stanford.io/3FXszd0

Content Generator

Free. Sign up to receive $100, Trade to receive $5500. Click Here:👉 https://millionairego.page.link/free

דירות דיסקרטיות בתל אביב

נוסד ב-1998 למשרד עורכי דין רות דיין ידע רב בדיני משפחה וניסיון בתיקי גירושין רגישים וסבוכים. משרדנו הינו חברת עורכי דין אשר הוקמה במקור בשנת 1997 ע"י עו"ד נדב שפירא. תחום השכרת חדרים לפי שעה בבאר שבע הינו תחום מתפתח בו קיימות אפשריות מפתות שמגיעות במחירים מפתיעים, שווה בדיקה. הינו אתר אינטרנט לפרסום מודעות דרושים לקציני בטיחות בתעבורה, טיפים לחברות לפני גיוס קצין בטיחות בתעבורה לארגון. חשוב לדעת כל המפרסמים מודעות באתר גולד אסקורטס הצהירו כי השירותים הניתנים הינם שירותי עיסוי בלבד. עיסוי מקצועי על ידי צביקה שנקר. כן, לוותר על הלילות המטורפים שלנו, על משחקי המין שלנו ועל כל מה שכישף אותי במשך חודשים. נערות סקס ליווי בחולון לעיסוי שלנו יודעות לענות על כל דרישה של לקוחות עניני טעם. שירותי ליווי באשדוד ואשקלון - כל סקס שאתה יכול להעלות על דעתך… חברת טיולים זה אנחנו, מספקת שירותי הסעות והיסעים למטרות שונות ובהתאם לצרכי הלקוחות שלנו. פילטר בר - מערכת אוסמוזה הפוכה חברת פילטר בר עוסקת בשרות ואספקה של מוצרים בתחום טיהור והשבחת המים למגזר הפרטי והעסקי בזמן מתן שירות מהיר לצרכי הלקוח. משלוחים מהירים שירות מהיום להיום, שירותי מסירות משפטיות לעורכי דין, הובלות קטנות.

bit.ly

ישנן עדויות לכך שעיסוי יכול לעזור לנשים בהריון בבריאות הנפשית, כאבי גב תחתון וכאבי לידה. העיסוי מפנק מיועד לסובלים מכאבי שרירים או מתח בשרירים, לסובלים מכאבי ראש או כאבי גב, למעוניינים לשפר את טווח התנועה, למעוניינים להמריץ זרימת דם בגפיים (למשל נשים בהריון) וכמובן לאלו הזקוקים להפחתת מתח נפשי. עיסוי הכי מפנק בבת ים. תושבי חולון יכולים להזמין נערות ליווי לדירות דיסקרטיות בשכונות החדשות או הותיקות של העיר, לתת עדיפות לחדרים לפי שעה כדי לשמור על גמישות וספונטניות וכמובן גם ליהנות ממגוון רחב של בתי מלון קרובים ביפו, תל אביב ובת ים. קיים מבחר רב של אתרים או פורטלים שפרסמים מודעות של סוכנויות או משרדים ושירותי ליווי, ושאר האתרים הם אתרים פרטיים של סוכניות או משרדי ליווי כמובן, אבל רק אנכנו מצעים לך מגוון ממש רחב של בחורות שלא תוכל למצא באף אתר או פורטל אחר, אז תמהר להיתרשם מהמבחר הגדול שלנו. זה הוא לא פורום של סוכנות או משרד ליווי בודד - זה אתר שמספק מגוון עצום של משרדי ליווי. עיסוי יד 2 בית שמש אתר ההטבות של Max חבילות ספא .

zmozeroteriloren

I take pleasure in, lead to I found exactly what I used to be taking a look for. You have ended my four day lengthy hunt! God Bless you man. Have a great day. Bye

https://exoticsenualoriental.com/categor/Discreet-apartments-in-Kfar-Saba.php

כמובן שאתם יכולים גם להתייעץ עמנו לגבי בחירה של דירה דיסקרטית, ואנו נשמח להמליץ לכם על מקומות מעולים שתוכלו להיות מרוצים מהם. מעוניינים למצוא דירה דיסקרטית בנס ציונה ? ישנם אנשים שמקבלים עיסויים למטרות פינוק וכייף בביתם ולפעמים מגיעים לדירה דיסקרטית בפתח-תקוה אך גם ישנם אנשים המבקשים לעבור עיסוי במרכז בעקבות כאב מסוים. ישנם אנשים שמקבלים עיסויים למטרות פינוק וכייף בביתם ולפעמים מגיעים לדירה דיסקרטית בחיפה אך גם ישנם אנשים המבקשים לעבור עיסוי בצפון בעקבות כאב מסוים. מדובר על מעין "כרטיסיית עיסויים בפתח-תקוה!" שאתם רוכשים מראש, כך שתוכלו לקבוע עם המעסה מפעם לפעם בהתאם ללוח הזמנים שלכם ולצרכים שלכם. עיסויים בקרית שמונה/נהריה משפרים באופן ניכר, את כל מערכות הגוף וכן, הם מרגיעים את מערכת העצבים, מה שיגרום להפחתת המתחים. זה יכול להיות בגלל שאתה רוצה לשמור על קו מחשבה מסוים בקרב הקולגות שלך, להרשים את האקסית שאתה יודע שגם היא תהיה נוכחת, או פשוט בגלל שאתה לא צריך שההורים שלך יערערו שוב על ההחלטות שלך כשאתה משתתף בחתונה של בן דוד. המרצה שלי בערך בן 40, כן כן, אני שמעתי כבר את כל התגובות. Also visit my webpage ... https://exoticsenualoriental.com/categor/Discreet-apartments-in-Kfar-Saba.php

https://getluckywithliz.com/regions/Discreet-apartments-in-Rehovot.php

השוואת מחירים של קליניקות לטיפולי תא לחץ בארץ - הירשמו וקבלו הנחה! השלווה, הנינוחות והרוגע שמשרה על תושביה ומבקריה עיר כמו נס ציונה יכולים להועיל לכל מי שנפשו וגופו זקוקים למנוחה, להורדת לחץ ולהקלת המתח בעזרת עיסוי בנס ציונה. תל אביב אמנם עיר רוויה בהנאות, בילויים ותשוקות אבל נערת ליווי מושלמת זו אחת שעברה אימות, רואיינה והיא מוכנה לכל תרחיש ולכל בילוי שרק תרצו או תבחרו. איך נפגשים עם נערת ליווי תל אביב? אז אם בעבר גם פגשתם נערות ליווי בתל אביב אבל הן היו שונות אלף שנות אור ממה שהכרתם עד כה אולי כדאי לדבר על פורטל אחראי שיודע ויכול להבטיח לכם - מכאן אתם מקבלים את הבילוי המושלם עם נשים מדהימות, חייכניות, לוהטות, סקסיות בטירוף והכי חשוב נוטפות סקס בדיוק כמו שאתם אוהבים ורוצים. עם זאת, תוכלו לשבור את השגרה המוכרת והידועה מראש עם עיסוי ברמת-גן! עם זאת, תוכלו לשבור את השגרה המוכרת והידועה מראש עם עיסוי באשקלון! כאן תוכל למצוא את המקום להזמין את הדבר האמיתי. כאן אין סיכונים, בפורטל היוקרתי ביותר שלנו אולי יידרש מכם לשלם עלות יוקרתית יותר מאידך החדשות הטובות הן כי התשלום זה הולך לספק לכם את השירותים הלוהטים ביותר ללא דופי ועם הפתעה אחת גמורה. Also visit my web site: https://getluckywithliz.com/regions/Discreet-apartments-in-Rehovot.php

https://bryoni-high-class-ebony-companion.com/region/Discreet-apartments-in-Nes-Ziona.php

אנחנו קליניקת בוטיק", היא אומרת. "בתחום האסתטיקה יש שני סוגים של קליניקות. ספא בוטיק לילקה הוא מקום שיחזיר לכם את החיים לשגרה עם מגוון עיסויים איכותיים! כמו כן, פועלות במתחם החוג מגוון קליניקות, המאפשרות לסטודנטים להתלוות לצוות של קלינאיות תקשורת מוסמכות ולהתנסות בשטח. החוג להפרעות בתקשורת (קלינאות תקשורת) במכללה האקדמית הדסה הוקם מתוך הביקוש הגובר לקלינאי תקשורת מקצועיים ומיומנים בישראל, שיכולים לשפר את חייהם של ילדים ומבוגרים כאחד. התכנים העיוניים הנלמדים מתמקדים בהכשרת הסטודנטים באיתור ומניעה של ליקויי שפה, למידה, שמיעה, דיבור ובליעה בקרב ילדים ומבוגרים. הסטודנטים מקיפים במהלך לימודיהם הן סוגיות באודיולוגיה (חקר השמיעה), והן נושאים מרכזיים בתחומי תקשורת, שפה, דיבור ובליעה. לחילופין, יכולים קלינאי התקשורת לעסוק במחקר, הוראה והדרכה בתחומים שונים השייכים להפרעות בתקשורת, בהם ליקויי למידה, ליקויי שמיעה וליקויי דיבור. תוכלו למצוא מספיק אתרים ברשת דוגמת סקס אדיר, איקספיינדר, בננה, סקס ענק, ליאור סקס, בנות חמות ועוד, בהם תוכלו למצוא דירות דיסקרטיות בכל רחבי ישראל. בעוד שלהייטקיסטים, היזמים, אנשי התוכן והמעצבים הגרפים קיימים מקומות רבים בהם ניתן להשכיר משרד קטן בבניין משרדים שיתופי, אנשי הטיפולים למיניהם מתקשים במציאת מקום אינטימי ומבודד ולעתים רבות הם אינם מסוגלים להשכיר מקום אישי לצמיתות ונאלצים להסתמך על חדר צפוף בביתם. Here is my blog ... https://bryoni-high-class-ebony-companion.com/region/Discreet-apartments-in-Nes-Ziona.php

https://nikkirain.com/categors/Discreet-apartments-in-Eilat.php

מלכא ושות' משרד עורכי דין הינו משרד אזרחי עם מוניטין הדואג להתאים עצמו לצורכי הלקוח ובכך בעצם מצליח משרד עורכי הדין לבסס את בנייתו על עבודה אישית, מסורה ומקצועית. עורך דין הוצאה לפועל דניס גילר מציע את שירותיו לייצוג משפטי בפשיטת רגל הן לחייבים הן לנושים. לצד כלים מתקדמים צוות קלדנים מוביל מציע לציבור שירותי תמלול וקלדנות בכל שפה, לכל מטרה ובכל מקום בארץ. ביאנקה נערות ליווי בתל אביב נערת ליווי, ביאנקה נערות ליווי VIP שימו לב - המודעה הנ"ל לא מרמזת/מספקת ו/או מפרסמת שירותי מין ביאנקה תעניק לך עיסוי ופינוק שלא חווית מעולם. הזמן שירותי ליווי בבת ים או שירותי ליווי בחולון לביתך / מלון והגשם את הפנטזיות שלך. אפשר להזמין נערת ליווי גם למלון! מספרים וטלפונים להזמין זונות באתר סקס שלנו באזור בנתניה. כל שנשאר לכם לעשות הוא להשתמש בפורטל סקס אש ולקבוע פגישה עם אחת מהנשים המטריפות והאיכותיות המתגוררות בעיר. הפסיכולוג שלך יידע לנהוג בשיוויון כלפי כל המטופלים שהוא פוגש - הוא ינהג במידה זהה של כבוד עם מטופל שהוא רואה בחינם ועם מטופל שמשלם מחיר מלא. עם עיסוי שמגיע עד הבית, אתם יכולים לשבת רגל על רגל ולהמתין למעסה שיגיע. Also visit my blog; https://nikkirain.com/categors/Discreet-apartments-in-Eilat.php

Book That Condo

I enjoy what you guys tend to be up too. Such clever work and exposure! Keep up the amazing works guys I've incorporated you guys to blogroll.

Children & Teen Books

As I website owner I think the content here is rattling superb, regards for your efforts.

How to Write a Business Plan for a Bogie For Locomotive Business

I really like studying and I think this website got some genuinely utilitarian stuff on it! .

The Best Places to get Married in Tehran (Iran)

Great – I should certainly pronounce, impressed with your web site. I had no trouble navigating through all tabs and related info ended up being truly easy to do to access. I recently found what I hoped for before you know it at all. Quite unusual. Is likely to appreciate it for those who add forums or anything, website theme . a tones way for your customer to communicate. Excellent task..

The Best Places to Retire in Basseterre (Saint Kitts and Nevis)

Hi there! This post couldn’t be written any better! Reading through this post reminds me of my previous room mate! He always kept talking about this. I will forward this article to him. Pretty sure he will have a good read. Thank you for sharing!

Top Places to Holiday in Pristina (Kosovo[g])

This blog is definitely rather handy since I’m at the moment creating an internet floral website – although I am only starting out therefore it’s really fairly small, nothing like this site. Can link to a few of the posts here as they are quite. Thanks much. Zoey Olsen

How to Become a Pigment Furnace Tender

I am glad to be a visitor of this unadulterated web blog! , thanks for this rare information! .

The Best Places to Drink in Yingde (China)

I besides conceive thence, perfectly indited post! .

How to Write a Business Plan for a Custom Tailored Outerwear For Men And Boys Business

My brother suggested I might like this blog. He was entirely right. This post actually made my day. You can not imagine simply how much time I had spent for this info! Thanks!

Handbook Guide to a CitroÃŽn - CITROEN 7C (12) (Classic Handbook Car Guide)

Loving the info on this web site, you have done outstanding job on the posts.

The Best Places to Go for New Years Eve in Sucre (Bolivia)

I know this if off topic but I'm looking into starting my own blog and was wondering what all is required to get setup? I'm assuming having a blog like yours would cost a pretty penny? I'm not very web savvy so I'm not 100 certain. Any suggestions or advice would be greatly appreciated. Cheers

The Best Places to Go for New Years Eve in Niamey (Niger)

F*ckin’ remarkable things here. I’m very glad to see your post. Thanks a lot and i am looking forward to contact you. Will you please drop me a mail?

Top Places to Holiday in Jiaxing (China)

I'd forever want to be update on new articles on this website , saved to favorites! .

промокод в мелбет

купоны мелбет. Click Here:👉 https://bit.ly/3YSgux0

эротический видеочат с девушками

порно секс онлайн. Click Here:👉 http://rt.livepornosexchat.com/

The Best Places to get Married in Katowice (Poland)

Fantastic web site. Lots of useful info here. I am sending it to a few friends ans also sharing in delicious. And of course, thank you in your sweat!

How to Become a Receipt-and-report Clerk

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You clearly know what youre talking about, why waste your intelligence on just posting videos to your blog when you could be giving us something enlightening to read?

Top Places to Eat in Banjul (Gambia)

A powerful share, I simply given this onto a colleague who was doing a little bit evaluation on this. And he actually bought me breakfast as a result of I found it for him.. smile. So let me reword that: Thnx for the deal with! However yeah Thnkx for spending the time to discuss this, I really feel strongly about it and love studying more on this topic. If doable, as you develop into experience, would you mind updating your blog with extra particulars? It's extremely useful for me. Large thumb up for this blog put up!

Beginners Guide to Growing Pseudowintera (Home & Garden Handbook)

Nice post. I was checking constantly this blog and I am impressed! Very helpful info specifically the last part :) I care for such information a lot. I was seeking this certain information for a very long time. Thank you and best of luck.

Daniell

You're doing a terrific job!

Code Promo 1xBet

Code Promo 1xBet. Click Here:👉 https://popvalais.ch/wp-includes/inc/?code-promo-1xbet-burkina-faso-78-000xof.html

промокод 1хбет

промокод 1хбет. Click Here:👉 https://www.medtronik.ru/images/pages/bonus_kod_na_1xbet_pri_registracii_6500_rubley.html

Промокод 1xbet

Промокод 1xbet. Click Here:👉 http://www.newlcn.com/pages/news/promo_kod_1xbet_na_segodnya_pri_registracii.html

1xbet promo code

1xbet promo code. Click Here:👉 http://https://www.lafp.org/includes/pages/1xbet-promo-code-1xbet-bonus.html

Visit My Site

Visit My Site

промокод 1хбет 2023

Artificial intelligence creates content for the site, no worse than a copywriter, you can also use it to write articles. 100% uniqueness,5-day free trial of Pro Plan :). Click Here:👉 https://whitestudios.ru/kassa/incs/1xbet_besplatno_stavka-2021.html

промокод хбет

Artificial intelligence creates content for the site, no worse than a copywriter, you can also use it to write articles. 100% uniqueness,5-day free trial of Pro Plan :). Click Here:👉 https://dakelin.ru/news/promokod_143.html

CHATGPT DOWNLOAD 2023 TUTORIAL

CHATGPT DOWNLOAD 2023 TUTORIAL - FREE VERSION https://youtu.be/c5UdOH2kJQc

seosager4

Outline your post. Any great blog post starts with an outline. We never publish a blog post that we wrote 5 minutes before publishing http://thetopdirectory.com/listings12464394/1-800-299-7264-lufthansa-airlines-number-for-reservations

multiple wallets metamask

My spouse and I absolutely love your blog and find almost all of your post's to be exactly I'm looking for. Do you offer guest writers to write content in your case? I wouldn't mind publishing a post or elaborating on a number of the subjects you write in relation to here. Again, awesome web log!

Phone Number For Reservations

Phone Number For Reservations:👉 http://pastebin.com/Fj8xx03Z

1xbet ka promo code

1 x bet promo code bangladesh. Click Here:👉 https://www.lafp.org/includes/pages/1xbet-promo-code-1xbet-bonus.html

секс чат рулетка онлайн без регистрации

эро чат онлайн. Click Here:👉 https://rt.beautygocams.com/

бонус код мелбет

melbet промокод при регистрации. Click Here:👉 https://mebel-3d.ru/libraries/news/?melbet_2020_promokod_dlya_registracii_besplatno.html

1xbet code promo burkina

Code Promo 1xBet https://www.planeterenault.com/UserFiles/files/?code_promo_69.html

comment utiliser son code promo 1xbet

Code Promo 1xBet https://www.planeterenault.com/UserFiles/files/?code_promo_69.html

Vincze Andrea fodrász

I like what you guys are up too. Such clever work and reporting! Keep up the superb works guys I have incorporated you guys to my blogroll. I think it will improve the value of my website :)

https://brittanyescourt.com/categors/Discreet-apartments-in-Karmiel.php

כל בחורה אוהבת לקבל מסאז' מהגבר שלה- בגב, בכתפיים, באזור הצוואר והראש. בקרו בפורטל, בחרו את המודעה המתאימה לכם, עשו את סקר השווקים האחרון וצאו לדרך מלאה בהנאות ורוויה בהגשמת כל הפנטזיות הלוהטות עליהן חלמתם. תמיד רציני לנייש אבל לא היה קל למצוא את המתאים. כאשר למשל אתם נוסעים לנופש באיזה צימר מפנק, או בית מלון, תמיד תחשבו ישר על הפינוק של עצמכם ותזמינו עיסוי, כי אם כבר אז כבר. תוכלו להגיע לבד אם הינכם מעוניינים בשקט והפוגה מעולמכם הרועש, וכן תוכלו להגיע עם בן או בת זוג אהובים לבילוי רומנטי משותף. מסאג לומי לומי,טיפול עם דבש ושמנים ארומטים. דירה דיסקרטית כאמור זהו ״דירת מבטחים״ בה תוכל להיפגש עם מטפלות האהובות עליך, הרצויה לך, זאת שנמצאת בדירה דיסקרטית בקריות ובכלל, זאת דירה בה המעסה האירוטית מתגוררת או בה היא עובדת. מחפשים באתר בחורה בדירה דיסקרטית בקריות והנה לך ערב סקסי שקט וחופשי מדאגות. בחורה פרטית, מחכה לך בדירה דיסקרטית שהיא… Here is my web site https://brittanyescourt.com/categors/Discreet-apartments-in-Karmiel.php

https://onemodellondon.com/categors/Discreet-apartments-in-Ramat-Gan.php

כמו כן, אם אתם מחפשים עיסוי ארוטי בפתח תקווה באזור, סביר מאד להניח שאתם גם תוהים מה היתרונות של הטיפול הזה בכלל, ומתברר שגם זה משהו שאנשים לא כל כך מבינים לעומק ולכן נחלוק אתכם גם את המידע החשוב הזה. באופן טבעי, עיסוי ארוטי, על אף היותם טיפולים מקצועיים שבהחלט מביאים להקלה על הגוף והנפש, הם כאלו שאנשים לא נוטים להתייעץ לגביהם עם חברים או בני משפחה וזה משהו שיכול להפוך את האיתור של עיסוי ארוטי בפתח תקווה למעט מורכב יותר. לצורך כך ניתן להיכנס לפורומים מקצועיים ברחבי הרשת ולשאול שם אנשים אובייקטיביים לגבי עיסוי ארוטי בפתח תקווה באזור. הצג מספר |. יפתח בשעה: 9:00. בקליניקה של קורל תמצאו מגוון רחב של טיפולים מקצועיים : עיסויים מכל הסוגים, כגון עיסוי שוודי, עיסוי קלאסי, אבנים חמות, עיסוי ספורטאים, בנוסף גם פילינג גוף, מניקור ופדיקור… ללא פשרות זה קורה על הצד הטוב ביותר, מגוון שירותים שנמצאים בתוך דירה שנבדקה מראש בצורה פרטית והדיסקרטית ביותר באזור פתח תקווה. כאן תוכל למצוא מגוון רחב של דירות סקס בכפר סבא והסביבה כולל כתובות, טלפונים וניווט שיביא אתכם היישר לעונג. כאן תוכלו למצוא את הטוב ביותר בדירה דיסקרטית שאף אחד לא יגיע או יחפש אתכם- דירות פרטיות נקיות העונות על כל הסטנדרטים החשובים והקריטיים והכול במטרה אחת - לעשות לכם את ההנאות כמה שיותר גבוהות , חזקות ומעצימות. my blog post ... https://onemodellondon.com/categors/Discreet-apartments-in-Ramat-Gan.php

https://claudinemarquisseprivatecompanionship.com/region/Discreet-apartments-in-Tel-Aviv.php

חברתנו מתמחה בתחום ייבוא הכלים כעשר שנים ומשווקת אותם לחנויות מובחרות וגם ישירות ללקוח הסופי עם דגש על מוצרים איכותיים שעוברים בדיקות קפדניות ועומדים בכל התקנים טרם הגעתם ללקוח הסופי. זה כבר למעלה מ 20 שנים שחברת אוהלי אוהד מעניקה שירותי השכרת אוהלים ללקוחותיה בישראל, מדרום ועד צפון. יומן פגישות חכם ש"מכיר" כבר את כל הטיפולים והלקוחות שלך - לקביעת תור קלה וסופר מהירה! קל פשוט ונוח לבנות קמפיין פרסום מצליח בגוגל עם איזי אדס, מערכת הפרסום בגוגל המאפשרת לך לתכנן ולבדוק באופן ממוקד ופשוט כך שכל אחד יכול לפרסם בגוגל החל מתקציב של 300 ש' בלבד לחודש ואתה כבר באויר! כאשר מדובר בטלפוניה שהיא סחבת, עם מענה ממושך, HOLD, ביורוקרטיה מסובכת והמון פקידים עד שמגיעים לרישום, מישהו כנראה מעדיף להשקיע כסף שם ולא באנשי מקצוע טובים, ובכך - מי שנרשם לשם למעשה כורת את הענף עליו הוא יושב. בעולם בו המציאות משתנה בקליק, בעידן בו רבים מפרסמים ובכל פינה מתנוסס לו מוצר מתחרה חדש - חשוב יותר מתמיד המסר שלך, הסיבה והסיפור עליו נשען המותג שלך, הצורך למתן פתרון קריאייטיבי פורץ דרך. Look at my web-site :: https://claudinemarquisseprivatecompanionship.com/region/Discreet-apartments-in-Tel-Aviv.php

Checking wallets

ZkSync Free Airdrop Crypto: Your Guide to Free Coins in 2023, EARN MORE THAN $1000! https://www.youtube.com/watch?v=o1JvjQA-s-M

Checking wallets

ZkSync Free Airdrop Crypto: Your Guide to Free Coins in 2023, EARN MORE THAN $1000! https://youtu.be/dvySbggYL_M

slot spadegaming gratis

What¦s Happening i'm new to this, I stumbled upon this I've found It positively helpful and it has helped me out loads. I'm hoping to give a contribution & help different customers like its helped me. Good job.

נערות ליווי

Everything is very open with a really clear explanation of the issues. It was definitely informative. Your website is very helpful. Thanks for sharing!

Crypto casino

Your bonus from http://gg.gg/13oh3t connect your wallet and enter promo code (3gSwd234) and get 0.5 eth + 300 free spins, Withdrawal without

slot terbaik

you have a great blog here! would you like to make some invite posts on my blog?

cq9 slot

Everything is very open and very clear explanation of issues. was truly information. Your website is very useful. Thanks for sharing.

Blur CRYPTO Airdrop

Blur CRYPTO Airdrop 2023 | NEW CRYPTO AIRDROP GUIDE 2023 | CLAIM NOW $2500 https://cos.tv/videos/play/43670739785125888

Blur CRYPTO Airdrop

CLAIM SPACE ID AIRDROP 2023 | EARN MORE THAN 1.007ETH | LAST CHANCE https://t.co/5I6J1BLRko

yggdrasil slot login

Great line up. We will be linking to this great article on our site. Keep up the good writing.

Crypto Exchanges

New Crypto Arbitrage Strategy | 20% profit in 10 minutes | Best P2P Cryptocurrency Trading Scheme +1200$ profit in 10 minutes https://cos.tv/videos/play/43784613877027840

demo slot pragmatic maxwin

I was very pleased to find this web-site.I wanted to thanks for your time for this wonderful read!! I definitely enjoying every little bit of it and I have you bookmarked to check out new stuff you blog post.

Wilson

Yes! Finally someone writes about אתר ליווי.

אתר ליווי