Safety in “Store” for This Dividend

People who throw things out are my heroes.

While you won’t see me on an episode of Hoarders anytime soon, let’s just say it’s a good thing I have a big garage. It’s filled with what I call “mementos” – and what my wife calls “junk” – from my life. But I can’t get myself to toss it. What if I need that intramural hockey jersey from college some day?

Clearly, I’m not alone. That’s why self-storage facilities are booming and seen on seemingly every corner.

Public Storage (NYSE: PSA) is the world’s largest owner of self-storage facilities. It owns 2,386 self-storage facilities in 38 states. It also owns a minority interest in 222 facilities in seven European countries.

The stock pays a $2 per share quarterly dividend, which comes out to an annual yield of 4%. The company has raised its dividend every year since 2010. The last time it cut its dividend was 28 years ago.

Public Storage is set up as a real estate investment trust (REIT), which means it must pay out 90% of its income to shareholders in the form of dividends. As a result, the REIT doesn’t pay tax on its income.

| Question of the Week | |

| Only 27% of Americans start saving for retirement in their 20s. At what age did you first start saving? Click here to answer. |

According to Bloomberg, in 2017, Public Storage paid $1.63 billion in dividends (including dividends on its preferred stock), while generating $1.69 billion in funds from operations (FFO), which is a measure of cash flow for REITs.

That doesn’t leave a lot of room for error, but the company did cover it.

Next year, FFO is forecast by Bloomberg to climb 8% to $1.84 billion. Dividends, including those on its preferred stock, are expected to be $1.71 billion, giving the company a little more breathing room.

With a regular corporation, I like to see only 75% or less of cash flow paid out in dividends. It gives me comfort that if the company experiences a rough year or two, the dividend will not be cut.

However, with REITs and master limited partnerships, because they must pay out 90% of their earnings, they often pay most – if not all – of their cash flow in dividends. So you need a skilled management team that can grow the business to keep the dividend intact.

That appears to be the case with Public Storage. The dividend has not been lowered in nearly three decades. Though it paid out almost all of its cash flow in dividends last year, FFO is expected to grow again in 2018.

Should Public Storage’s FFO not grow to the levels expected, we could see a downgrade. But for now, given its history of a sustainable dividend and generating enough FFO to cover the divided, Public Storage’s dividend is safe.

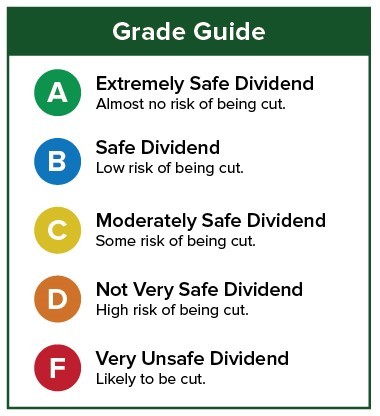

Dividend Safety Rating: A

If you have a stock whose dividend safety you’d like me to analyze, leave the ticker symbol in the comments section.

Good investing,

Marc

Gordon

Hi, very nice website, cheers! ------------------------------------------------------ Need cheap and reliable hosting? Our shared plans start at $10 for an year and VPS plans for $6/Mo. ------------------------------------------------------ Check here: https://www.good-webhosting.com/

129357

674807

499969

945449

861415

922919

861415

uinm42s5ll

861415

922919cw4yahc6ww

6q508e7jrn

922919

8614152d24i95nj2

922919

861415

922919

624257

0x8dblzhic

985965

iqkjqsuhkg

861415

zil3wvar3ms3za1wo28bf80ziqojca94xwpkh77vw

0rs45wjscn148baxx3hco990rrxklbi56xylq8hw6

922919

861415

922919

624257

738bh3vzoudbkim49atj0gl73y9rxiukica02nsbh

985965

zkn3yvcr5mu31a3wq2abh82zkqqjeac50xslk8awz