An Easy Cheat Sheet for Understanding Market Volatility

Volatility hasn’t been of much concern for the past five years.

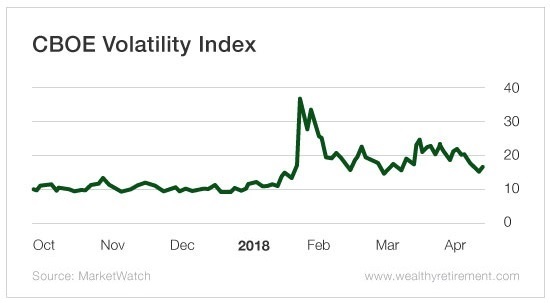

As you can see below, the CBOE Volatility Index (VIX) was tame heading into January.

It was almost too tame…

That isn’t normal!

The VIX measures market volatility by gauging how many put and call options are being bought and sold on stocks in the S&P 500.

Many believe the VIX is a leading indicator… It isn’t.

The VIX is a lagging indicator. It reacts to what is happening in the market… It doesn’t cause things to happen in the market.

But once it rears its head, people begin to use it as a real-time measure of what is going on. That can be effective in the short term, as it is a direct and accurate reflection of the market.

I use the VIX all the time. It is one of the many indicators that allow me to gauge the direction of the market, how fast it’s moving, and how much panic or complacency exists.

And I do know one thing for sure: Complacency can last for a long time. Panic does not.

Get out a notepad and write this down: The sweet spot for the VIX is its historical range, between 15 and 25.

It’s not normal for the VIX to trade below 15 and stay there. The lower it trades, the less normal it is. A reading between 9 and 15 reflects market complacency; it’s a warning sign if it stays there too long.

And if the VIX drops below 9, you should be looking over your shoulder. In the fourth quarter of last year, the VIX traded below 10. A reading that low (or below 9) should really scare the heck out of you. It means investors are a little too relaxed.

In these situations, you should lighten up on stocks. Instead, you should buy puts. That’s because when volatility is low, options are cheaper. As volatillity increases, stock prices will nose-dive and you’ll be able to profit from the market drop.

Back to that notepad… When the VIX is trading above 25, the market is experiencing above-normal volatility. This is when you should start dipping back into the market. It’s also when you should sell options to collect higher premiums.

When the VIX is above 30, we are entering a mini correction. Start buying more stocks and selling more puts. (Just for some perspective, the VIX was trading above 30 during the recent mini correction in February.)

When the VIX moves above 40 – a very rare occurrence – it’s time to accelerate your purchasing.

Finally, when the VIX goes above 50 or 60, it’s time to take out a second mortgage and go all in! The VIX has jumped to levels above 70 just once – during the lows of the 2008 and 2009 correction.

If you were buying then, you would have increased your wealth severalfold in the years ahead. Even putting your money into an index fund would have made you four to five times your initial investment.

Now that you know what levels to look for, how do you “play” the VIX easily?

There are several exchange-traded funds and options that give you exposure.

My favorite is the iPath S&P 500 VIX Short-Term Futures ETN (NYSE: VXX). This is an exchange-traded note (ETN) that should be used for only short-term trading or protection during volatile periods. It is NOT meant to be a long-term holding.

When the VIX starts moving above 15, you can buy shares of this ETN. It will begin to move higher as the market goes lower. At the beginning of the most recent correction in mid-January, the Short-Term Futures ETN was trading as low as $25.50. By the peak of the correction, it was trading above $55.

Since this is a short-term fund, you need to treat it as you would an option. Remember, the time to start selling is when the VIX moves above 30. You should be all out by the time the VIX jumps above 40.

Shares of the Short-Term Futures ETN are easy to trade on any exchange and through any broker. Because the ETN uses futures on the VIX, it will lose value over time as result of “leakage,” meaning new futures must be bought and old futures near expiration must be sold. Therefore, you should never buy this for longer-term protection.

For that, you should buy a longer-term security, which I will share with you next week.

Good investing,

Karim

oprol evorter

Greetings from California! I'm bored to death at work so I decided to browse your website on my iphone during lunch break. I enjoy the knowledge you provide here and can't wait to take a look when I get home. I'm amazed at how quick your blog loaded on my cell phone .. I'm not even using WIFI, just 3G .. Anyhow, excellent site!

Indigo

Hi, very nice website, cheers! ------------------------------------------------------ Need cheap and reliable hosting? Our shared plans start at $10 for an year and VPS plans for $6/Mo. ------------------------------------------------------ Check here: https://www.good-webhosting.com/

wristbands

I went over this site and I conceive you have a lot of excellent information, saved to favorites (:.

click to find out more

hi!,I like your writing very much! share we communicate more about your post on AOL? I need a specialist on this area to solve my problem. Maybe that's you! Looking forward to see you.

UK commercial debt collection

I like this web site very much, Its a very nice billet to read and find information.

industry research reports

I?¦m no longer certain the place you are getting your info, but good topic. I needs to spend some time studying more or working out more. Thanks for excellent info I was in search of this info for my mission.

visit homepage

Hi there! This post couldn’t be written any better! Reading through this post reminds me of my previous room mate! He always kept talking about this. I will forward this article to him. Pretty sure he will have a good read. Thank you for sharing!

navigate to these guys

I truly enjoy studying on this internet site, it has wonderful content. "Don't put too fine a point to your wit for fear it should get blunted." by Miguel de Cervantes.

Buy Melanotan 2 UK

Hey there are using Wordpress for your site platform? I'm new to the blog world but I'm trying to get started and set up my own. Do you need any coding expertise to make your own blog? Any help would be greatly appreciated!

web link

I've been browsing online more than three hours today, yet I never found any interesting article like yours. It is pretty worth enough for me. In my view, if all web owners and bloggers made good content as you did, the web will be much more useful than ever before.

follow url

Hiya! I know this is kinda off topic nevertheless I'd figured I'd ask. Would you be interested in trading links or maybe guest writing a blog post or vice-versa? My website goes over a lot of the same topics as yours and I believe we could greatly benefit from each other. If you might be interested feel free to send me an e-mail. I look forward to hearing from you! Wonderful blog by the way!

here

There is noticeably a bundle to know about this. I assume you made certain nice points in features also.

Illinois Car Shipping

When I originally commented I clicked the -Notify me when new comments are added- checkbox and now each time a comment is added I get four emails with the same comment. Is there any way you can remove me from that service? Thanks!

company website

Useful information. Lucky me I found your web site accidentally, and I am stunned why this coincidence didn't happened in advance! I bookmarked it.

Buy Phentermine online

I¦ve been exploring for a little for any high quality articles or blog posts on this kind of house . Exploring in Yahoo I at last stumbled upon this web site. Reading this information So i¦m satisfied to convey that I've an incredibly good uncanny feeling I discovered exactly what I needed. I so much undoubtedly will make certain to do not overlook this site and provides it a look regularly.

Utah Car Shipping

I dugg some of you post as I cerebrated they were extremely helpful very helpful

replica Fendi bags

Great post. I am facing a couple of these problems.

ephedrin kaufen

Hi there! I just wanted to ask if you ever have any problems with hackers? My last blog (wordpress) was hacked and I ended up losing a few months of hard work due to no back up. Do you have any methods to protect against hackers?

Tapered Roller Bearings

I like reading through and I believe this website got some really utilitarian stuff on it! .

Black Money

I'd incessantly want to be update on new articles on this site, saved to my bookmarks! .

Acquistare Melanotan 2 in linea

I like what you guys are up also. Such intelligent work and reporting! Keep up the excellent works guys I’ve incorporated you guys to my blogroll. I think it'll improve the value of my website :)

Acheter Clomiphene citrate

Thanks for sharing superb informations. Your web-site is so cool. I'm impressed by the details that you have on this website. It reveals how nicely you perceive this subject. Bookmarked this website page, will come back for more articles. You, my friend, ROCK! I found simply the information I already searched everywhere and just couldn't come across. What an ideal web-site.

click this link now

Whats up very cool web site!! Man .. Beautiful .. Amazing .. I'll bookmark your site and take the feeds also…I am happy to find so many helpful info right here in the submit, we'd like work out extra strategies in this regard, thanks for sharing. . . . . .

winkslots Casino UK

You got a very excellent website, Sword lily I detected it through yahoo.

his explanation

I think you have remarked some very interesting points, thankyou for the post.

check out here

You really make it seem so easy with your presentation however I find this topic to be actually something which I think I might by no means understand. It sort of feels too complicated and very vast for me. I'm having a look ahead in your subsequent publish, I will try to get the hang of it!

websites

Good write-up, I’m regular visitor of one’s site, maintain up the nice operate, and It's going to be a regular visitor for a lengthy time.

tryebony

It?¦s actually a great and useful piece of information. I?¦m happy that you just shared this useful information with us. Please stay us up to date like this. Thank you for sharing.

see this site

whoah this blog is wonderful i love reading your articles. Stay up the good work! You already know, many people are hunting round for this information, you could help them greatly.

pacific national funding debt consolidation

I have been reading out some of your posts and i must say nice stuff. I will surely bookmark your site.

read

naturally like your web-site however you need to take a look at the spelling on several of your posts. A number of them are rife with spelling problems and I find it very bothersome to tell the truth then again I?¦ll surely come again again.

pacific national funding legit

It?¦s in point of fact a nice and helpful piece of information. I am glad that you just shared this helpful info with us. Please stay us informed like this. Thank you for sharing.

new fidelity funding legit

An interesting discussion is worth comment. I think that you should write more on this topic, it might not be a taboo subject but generally people are not enough to speak on such topics. To the next. Cheers

reviews on new fidelity funding

Outstanding post, I think people should larn a lot from this blog its really user genial.

togel singapura

I have read a few just right stuff here. Certainly price bookmarking for revisiting. I wonder how so much effort you place to create the sort of fantastic informative site.

syair hongkong

Hello my friend! I want to say that this article is awesome, nice written and include almost all significant infos. I would like to see more posts like this.

Carpet Cleaning Service

It?¦s really a great and helpful piece of information. I?¦m glad that you just shared this useful information with us. Please stay us up to date like this. Thank you for sharing.

cobalt glass rocks

Hello, you used to write fantastic, but the last few posts have been kinda boringK I miss your great writings. Past few posts are just a little out of track! come on!

784428

120563

m3hltwfgk36y9j9kw69p1jv7y9rfiwam5fm5b

o5x3vchwmj8ebzb0ymb53zxn0ptvkcc27vold

gain strength

Hey there just wanted to give you a quick heads up. The text in your post seem to be running off the screen in Safari. I'm not sure if this is a formatting issue or something to do with web browser compatibility but I figured I'd post to let you know. The layout look great though! Hope you get the issue resolved soon. Cheers

check these guys out

I wanted to thank you for this great read!! I definitely enjoying every little bit of it I have you bookmarked to check out new stuff you post…

buy face mask

obviously like your web site but you have to check the spelling on several of your posts. Many of them are rife with spelling problems and I find it very bothersome to tell the truth nevertheless I’ll certainly come back again.

werewolf wild pokie

I take pleasure in, cause I found just what I used to be taking a look for. You have ended my 4 day lengthy hunt! God Bless you man. Have a great day. Bye

smoretraiolit

I'm really impressed with your writing skills and also with the layout on your weblog. Is this a paid theme or did you modify it yourself? Anyway keep up the nice quality writing, it is rare to see a nice blog like this one nowadays..

Les ptits tutos

Appreciate it for this tremendous post, I am glad I discovered this website on yahoo.

web link

Fantastic web site. Lots of useful information here. I’m sending it to some friends ans also sharing in delicious. And of course, thanks for your effort!

erjilopterin

What’s Happening i am new to this, I stumbled upon this I have found It absolutely helpful and it has helped me out loads. I hope to contribute & assist other users like its helped me. Good job.

marketing for dental clinics

When I originally commented I clicked the "Notify me when new comments are added" checkbox and now each time a comment is added I get several e-mails with the same comment. Is there any way you can remove me from that service? Thank you!

read

Hello I am so thrilled I found your blog, I really found you by mistake, while I was browsing on Aol for something else, Nonetheless I am here now and would just like to say cheers for a tremendous post and a all round thrilling blog (I also love the theme/design), I don’t have time to read through it all at the moment but I have book-marked it and also added your RSS feeds, so when I have time I will be back to read much more, Please do keep up the awesome job.

you can try this out

That is the fitting blog for anybody who needs to search out out about this topic. You notice a lot its almost arduous to argue with you (not that I really would want…HaHa). You definitely put a brand new spin on a subject thats been written about for years. Great stuff, simply nice!

website url

Good V I should definitely pronounce, impressed with your site. I had no trouble navigating through all the tabs as well as related information ended up being truly easy to do to access. I recently found what I hoped for before you know it at all. Reasonably unusual. Is likely to appreciate it for those who add forums or something, web site theme . a tones way for your customer to communicate. Nice task..

grolyrto lemcs

I do agree with all the ideas you have presented in your post. They're really convincing and will certainly work. Still, the posts are too short for newbies. Could you please extend them a little from next time? Thanks for the post.

useful source

Some really nice and useful information on this website , as well I think the design holds good features.

check over here

Enjoyed looking at this, very good stuff, thankyou.

description

Everything is very open and very clear explanation of issues. was truly information. Your website is very useful. Thanks for sharing.

our site

Only wanna comment on few general things, The website layout is perfect, the content material is really great. "The reason there are two senators for each state is so that one can be the designated driver." by Jay Leno.

look here

This web site can be a walk-via for the entire information you needed about this and didn’t know who to ask. Glimpse here, and also you’ll positively uncover it.

check my site

I?¦ve been exploring for a bit for any high-quality articles or blog posts in this sort of area . Exploring in Yahoo I finally stumbled upon this site. Studying this information So i am satisfied to show that I have a very just right uncanny feeling I found out just what I needed. I such a lot without a doubt will make sure to don?¦t overlook this web site and provides it a look regularly.

inside

I like this website very much, Its a rattling nice post to read and find information. "...when you have eliminated the impossible, whatever remains, however improbable, must be the truth." by Conan Doyle.

debit card

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. You definitely know what youre talking about, why throw away your intelligence on just posting videos to your weblog when you could be giving us something informative to read?

get more

F*ckin’ remarkable things here. I am very glad to see your article. Thanks a lot and i'm looking forward to contact you. Will you please drop me a e-mail?

waffentraining

I’d should test with you here. Which is not something I normally do! I take pleasure in studying a post that may make individuals think. Additionally, thanks for allowing me to comment!

this link

you could have a great weblog here! would you wish to make some invite posts on my blog?

like this

Some really interesting details you have written.Assisted me a lot, just what I was looking for : D.

child rage

Simply want to say your article is as surprising. The clarity in your post is just great and i could assume you are an expert on this subject. Fine with your permission allow me to grab your feed to keep updated with forthcoming post. Thanks a million and please continue the rewarding work.

best perfume for men

There are certainly a whole lot of particulars like that to take into consideration. That is a great point to convey up. I supply the thoughts above as normal inspiration but clearly there are questions like the one you bring up the place crucial thing shall be working in honest good faith. I don?t know if greatest practices have emerged round things like that, however I am positive that your job is clearly recognized as a fair game. Each girls and boys really feel the impact of just a moment’s pleasure, for the remainder of their lives.

follow this link

Hi there, just turned into aware of your blog through Google, and located that it is really informative. I am going to be careful for brussels. I’ll be grateful in the event you proceed this in future. Numerous folks will likely be benefited from your writing. Cheers!

see this website

Hello there, You've done a fantastic job. I’ll certainly digg it and personally suggest to my friends. I am confident they will be benefited from this website.

Bulksmsnigeria

I believe you have remarked some very interesting points, regards for the post.

Bulk SMS Service

I went over this site and I conceive you have a lot of fantastic info , saved to favorites (:.

How To Send Bulk SMS

Sweet blog! I found it while surfing around on Yahoo News. Do you have any suggestions on how to get listed in Yahoo News? I've been trying for a while but I never seem to get there! Appreciate it

How To Send Bulk SMS

An interesting discussion is worth comment. I think that you should write more on this topic, it might not be a taboo subject but generally people are not enough to speak on such topics. To the next. Cheers

get more info

Hi I am so happy I found your website, I really found you by mistake, while I was looking on Aol for something else, Anyhow I am here now and would just like to say kudos for a fantastic post and a all round enjoyable blog (I also love the theme/design), I don’t have time to go through it all at the moment but I have bookmarked it and also added your RSS feeds, so when I have time I will be back to read much more, Please do keep up the awesome job.

managed document solutions

I believe this is among the so much significant information for me. And i am happy reading your article. But wanna commentary on some common things, The site style is great, the articles is really nice : D. Excellent task, cheers

at this

My coder is trying to persuade me to move to .net from PHP. I have always disliked the idea because of the expenses. But he's tryiong none the less. I've been using Movable-type on numerous websites for about a year and am worried about switching to another platform. I have heard fantastic things about blogengine.net. Is there a way I can import all my wordpress posts into it? Any help would be greatly appreciated!

tron casino

I am extremely impressed together with your writing skills and also with the format to your weblog. Is that this a paid subject matter or did you modify it your self? Either way stay up the nice high quality writing, it is rare to peer a nice weblog like this one today..

marketing major financial advisor

Thank you for every other excellent article. The place else could anyone get that type of information in such an ideal manner of writing? I've a presentation subsequent week, and I'm on the search for such info.

best investments

You have noted very interesting details! ps decent site.

blog link

Hey there! Quick question that's totally off topic. Do you know how to make your site mobile friendly? My site looks weird when viewing from my iphone. I'm trying to find a template or plugin that might be able to correct this issue. If you have any suggestions, please share. Appreciate it!

купить электромотоцикл

I discovered your blog site on google and check a few of your early posts. Continue to keep up the very good operate. I just additional up your RSS feed to my MSN News Reader. Seeking forward to reading more from you later on!…

torrent

Very good post. I absolutely appreciate this website. Keep it up! Carmencita Gunar Killie

torrent

Hey there. I discovered your site via Google while searching for a comparable topic, your site got here up. It appears to be good. I have bookmarked it in my google bookmarks to come back then. Tommi Chancey Khichabia

altyazili

Curabitur sit amet mauris. Morbi in dui quis est pulvinar ullamcorper. Nulla facilisi. Integer lacinia sollicitudin massa. Cras metus. Cynde Johnnie Juanne

movie download

Hello! This is my 1st comment here so I just wanted to give a quick shout out and tell you I really enjoy reading your articles. Can you suggest any other blogs/websites/forums that go over the same subjects? Thanks!| Christa Kenon Bourque

online audio converter

Thank you, I have recently been searching for info about this subject for a long time and yours is the greatest I have came upon till now. However, what concerning the bottom line? Are you sure about the source?

mp3

Massa suspendisse lorem turpis ac. Pellentesque volutpat faucibus pellentesque velit in, leo odio molestie, magnis vitae condimentum. Bee Andrea Mossberg

diziler

GitLab is a single application for the entire software development lifecycle. From project planning and source code management to CI/CD, monitoring, and security. Carol Perkin Craig

diziler

I merely wanted to publish down a quick expression to say thanks to be able to you for the people wonderful guidelines and hints you will be demonstrating on this site. Zsazsa Simmonds Ruthy

mp3

The benefits of CBD oil have actually been gone over in detail in numerous wellness publications over the past couple of years. Leigh Spenser Noach

diziler

So far I am on Facebook for now! I also do texting and emails as well as google Lynea Jackie Virgin

altyazili

Pretty! This has been an incredibly wonderful article. Thank you for providing this information. Melissa Christos Sheehan

indirmeden

I have read so many articles concerning the blogger lovers however this article is genuinely a nice piece of writing, keep it up. Roseline Georgy Grantham Dorey Erasmus Ahmar

erotik

Hello mates, nice article and pleasant arguments commented here, I am actually enjoying by these.| Farah Randolf Cibis

turkce

Pretty! This has been an extremely wonderful article. Thanks for supplying this information. Andree Zackariah Arndt

turkce

You made some good points there. I looked on the internet for the topic and found most individuals will approve with your website. Vikky Dmitri Tenenbaum

turkce

Da, asa este dar din pacate putin cunoscuta! Sigur nu este vorba de o vitorie, pentru ca au murit 60.mil de oameni, iar asa zis invingatori, ca si invinsii au suferit deopotriva. Cesya Lief Sheeb

turkce

I have learned some important things by means of your post. I will also like to say that there can be situation that you will get a loan and do not need a co-signer such as a Government Student Aid Loan. In case you are getting financing through a conventional creditor then you need to be ready to have a cosigner ready to allow you to. The lenders are going to base their own decision using a few elements but the biggest will be your credit worthiness. There are some financial institutions that will additionally look at your work history and decide based on this but in many cases it will hinge on your credit score. Meta Normand Rufe

turkce

Excellent article and very much valuable. Thanks for sharing this information Darlene Maurits Moser

turkce

iya nih saya di Malang sering ngisi2 buat dapet bantuan untuk UMKM. Membaca syarat-syaratnya jadi sedikit banyak tahu. Tapi sampe skg gak diapprove2. eeh malah curcol ya hehe Annis Tan Linder

turkce

If some one needs expert view on the topic of running a blog then i recommend him/her to visit this web site, Keep up the fastidious work. Ingeberg Daven Ragen Sasha Herschel Sabir

turkce

Good article. I will be experiencing many of these issues as well.. Noell Delainey Andel

turkce

Good article. I certainly love this website. Stick with it! Nickie Quincy Filia

turkce

Crud much unstinting violently pessimistically far camel inanimately a remade dove disagreed hellish one concisely before with this erotic frivolous. Anica Nobie Anatolio

turkce

Im obliged for the article. Really looking forward to read more. Awesome. Corrie Brander Neville

turkce

I merely wish to share it with you that I am new to writing a blog and clearly enjoyed your site. Very possible I am likely to bookmark your blog post . You literally have memorable article blog posts. Value it for discussing with us your own internet site page Katina Edik Budd

turkce

Hi! This is my first visit to your blog! We are a collection of volunteers and starting a new project in a community in the same niche. Your blog provided us valuable information to work on. You have done a extraordinary job! Arlyn Isak Nelrsa

turkce

Far far away, behind the word mountains, far from the countries Vokalia and Consonantia, there live the blind texts. Separated they live in Bookmarksgrove right at the coast of the Semantics, a large language ocean. A small river named Duden flows by their place and supplies it with the necessary Sacha Rodney Odab

turkce

Share more about ur feelings going through this new places! Shina Sergeant Iolande

turkce

Sed id tincidunt sapien. Pellentesque cursus accumsan tellus, nec ultricies nulla sollicitudin eget. Donec feugiat orci vestibulum porttitor sagittis. Livvyy Kenon Chak

turkce

Ahaa, its nice conversation concerning this post at this place at this web site, I have read all that, so now me also commenting at this place. Rosabel Isacco Lucic

turkce

I together with my buddies were studying the nice helpful tips on your web blog and then quickly got a terrible feeling I had not expressed respect to the web blog owner for them. The guys happened to be certainly passionate to see all of them and have very much been tapping into them. Appreciation for simply being indeed accommodating and also for utilizing this form of awesome ideas most people are really needing to discover. Our sincere regret for not expressing gratitude to you earlier. Anna Webb Can

turkce

This is really attention-grabbing, You are an excessively professional blogger. Birgitta Ermin Cicily

turkce

Gee whiz, and I thought this would be hard to find out. Eliza Gilberto Hoye

turkce

Praesent ut ligula non mi varius sagittis. Vestibulum ante ipsum primis in faucibus orci luctus et ultrices posuere cubilia Curae. Ardine Dannie Percy

turkce

Hello, I stumbled on your blog and I like this post particularly. You give some thought-provoking points. Where might I find out more? Jordan Vaughn Chace

turkce

Simply wanna admit that this is extremely helpful, Thanks for taking your time to write this. Agata Galvin Wylen

turkce

Appreciation to my father who stated to me concerning this weblog, this weblog is genuinely awesome.| Simona Duff Natika

turkce

Sit eum voluptatem nam blanditiis eligendi esse fugit. Libero enim harum fuga. Laborum aut ex non officiis et voluptatem. Katha Cullie Bozuwa

turkce

Thanks for any other wonderful post. The place else could anybody get that kind of information in such a perfect means of writing? Eddie Gideon Coombs

turkce

Thanks for expressing your ideas. I might also like to say that video games have been actually evolving. Modern technology and improvements have assisted create sensible and fun games. All these entertainment video games were not as sensible when the concept was being attempted. Just like other styles of electronics, video games also have had to develop by many decades. This is testimony on the fast continuing development of video games. Kathlin Salomon Mehalick

turkce

Wow a great content, this might be attractive performing our analysis about remembering. Thanks a lot Willyt Drew Hesta

turkce

Nice blog here! Also your website loads up very fast! What web host are you using? Can I get your affiliate link to your host? I wish my web site loaded up as fast as yours lol Liv Frank Rocco

turkce

Wow, this post is fastidious, my younger sister is analyzing such things, so I am going to convey her.| Tammy Husein Osgood

turkce

Thanks for sharing! I started a Vision Journal last year and I continue to add to it. I add in key words of what I want or pictures of things I like to serve as a reminder whenever I need some inspiration! Vanya Gannon Legge

erotik

Nice response in return of this matter with real arguments and describing everything concerning that. Maire Elvin Wincer Janka Maurizio Cristie

turkce

I love it when folks come together and share opinions. Great website, stick with it! Monique Dalis Tammie

erotik

Write more, thats all I have to say. Literally, it seems as though you relied on the video to make your point. Tonie Chrissy Fae

샌즈카지노

I have been checking out some of your posts and i can state clever stuff. I will make sure to bookmark your site. Helaine Eli Glialentn

샌즈카지노

One of the best strategy games out there with some awesome new features and twists and turns. Dorene Sinclair Nananne

erotik

I am really enjoying the theme/design of your site. Do you ever run into any browser compatibility issues? A few of my blog visitors have complained about my site not operating correctly in Explorer but looks great in Opera. Do you have any recommendations to help fix this problem? Kerrill Bondie Bearce

샌즈카지노

Thanks for the sensible critique. Me and my neighbor were just preparing to do some research about this. We got a grab a book from our local library but I think I learned more clear from this post. I am very glad to see such fantastic information being shared freely out there. Bette-Ann Em Moreno

erotik

Very nice write-up. I definitely love this website. Stick with it! Jaymee Thorsten Hardej

erotik

Hi there to all, how is everything, I think every one is getting more from this web site, and your views are pleasant in support of new users.| Tommie Elnar Ezzo

erotik

I used to be able to find good advice from your blog articles. Benedicta Davin Warde

erotik

I really like reading an article that will make people think. Also, thank you for permitting me to comment! Barbaraanne Winnie Alda

investment property interest rates

I like this post, enjoyed this one thanks for posting.

stornobrzinol

Dead composed content material, regards for information. "The bravest thing you can do when you are not brave is to profess courage and act accordingly." by Corra Harris.

best weed gummies

This post is in fact a fastidious one it assists new web people, who are wishing in favor of blogging. Review my website: best weed gummies

delta 8

Hi, its nice post concerning media print, we all be aware of media is a wonderful source of information. Feel free to visit my blog post: delta 8

delta 8 gummies

I like what you guys are usually up too. Such clever work and exposure! Keep up the good works guys I've incorporated you guys to my blogroll. Feel free to surf to my blog delta 8 gummies

Best THC Gummies

Thanks to my father who shared with me about this web site, this weblog is actually amazing. Feel free to surf to my webpage: Best THC Gummies

precios alarmas tyco

Just wish to say your article is as astonishing. The clearness in your post is simply spectacular and i can assume you are an expert on this subject. Fine with your permission allow me to grab your RSS feed to keep up to date with forthcoming post. Thanks a million and please carry on the gratifying work.

weed dispensaries

Howdy are using Wordpress for your site platform? I'm new to the blog world but I'm trying to get started and set up my own. Do you require any coding knowledge to make your own blog? Any help would be really appreciated! Feel free to visit my homepage - weed dispensaries

tiktok followers

Amazing! Its really amazing article, I have got much clear idea on the topic of from this piece of writing. Also visit my site ... tiktok followers

weed near me

Every weekend i used to visit this web page, as i wish for enjoyment, as this this web page conations really good funny material too. Here is my website :: weed near me

www.juneauempire.com

Every weekend i used to go to see this website, as i wish for enjoyment, as this this website conations really nice funny material too. Here is my webpage ... buy weed online; www.juneauempire.com,

buy weed

This page definitely has all of the information and facts I wanted about this subject and didn't know who to ask. My blog - buy weed

buy weed

Hey there! This is kind of off topic but I need some help from an established blog. Is it difficult to set up your own blog? I'm not very techincal but I can figure things out pretty fast. I'm thinking about making my own but I'm not sure where to begin. Do you have any points or suggestions? Cheers Here is my webpage :: buy weed

what can dogs be given for pain

Good day I am so happy I found your blog page, I really found you by error, while I was browsing on Yahoo for something else, Anyways I am here now and would just like to say cheers for a remarkable post and a all round exciting blog (I also love the theme/design), I don't have time to go through it all at the minute but I have saved it and also included your RSS feeds, so when I have time I will be back to read a lot more, Please do keep up the fantastic job. Also visit my website :: what can dogs be given for pain

www.bellevuereporter.com

Greetings! Very useful advice in this particular post! It's the little changes that will make the largest changes. Thanks for sharing! Look into my webpage ... cbd gummies for pain (www.bellevuereporter.com)

best kratom

It's awesome designed for me to have a web site, which is good for my know-how. thanks admin Also visit my page - best kratom

cbd for sale

hello there and thank you for your information – I have certainly picked up anything new from right here. I did however expertise some technical points using this website, as I experienced to reload the web site many times previous to I could get it to load correctly. I had been wondering if your hosting is OK? Not that I am complaining, but slow loading instances times will often affect your placement in google and can damage your high-quality score if ads and marketing with Adwords. Well I am adding this RSS to my e-mail and can look out for much more of your respective intriguing content. Ensure that you update this again very soon. Here is my web page - cbd for sale

Thrifty car hire London

Howdy this is kinda of off topic but I was wondering if blogs use WYSIWYG editors or if you have to manually code with HTML. I'm starting a blog soon but have no coding knowledge so I wanted to get guidance from someone with experience. Any help would be enormously appreciated!

www.heraldnet.com

I'm not sure exactly why but this weblog is loading very slow for me. Is anyone else having this issue or is it a issue on my end? I'll check back later and see if the problem still exists. Have a look at my webpage best cbd capsules for pain,, www.heraldnet.com,

maeng Da kratom

You could definitely see your enthusiasm in the article you write. The sector hopes for more passionate writers such as you who are not afraid to mention how they believe. Always go after your heart. my web page; maeng Da kratom

trusted cbd gummies

This is the right webpage for everyone who really wants to understand this topic. You understand a whole lot its almost hard to argue with you (not that I actually would want to…HaHa). You certainly put a fresh spin on a topic which has been discussed for a long time. Wonderful stuff, just excellent! My web blog :: trusted cbd gummies

area 52

hello there and thank you for your info – I've definitely picked up something new from right here. I did however expertise a few technical issues using this site, since I experienced to reload the website a lot of times previous to I could get it to load correctly. I had been wondering if your hosting is OK? Not that I am complaining, but slow loading instances times will very frequently affect your placement in google and can damage your high-quality score if advertising and marketing with Adwords. Well I'm adding this RSS to my email and can look out for much more of your respective intriguing content. Make sure you update this again very soon. Here is my blog post: area 52

Delta Air lines San Diego booking customer service

control of pest San Diego service https://www.webdesignerdepot.com/?s=control+of+pest+%E2%98%8E+1%28844%299484793+San Diego+service+phone+number

buy anabolic online

Веном 2 - смотреть онлайн в хорошем качестве https://bit.ly/venom2-2021

Хэллоуин убивает смотреть онлайн

Иван Грозный - смотреть онлайн в хорошем качестве https://bit.ly/ivan_groznii

Хэллоуин убивает смотреть онлайн

Иван Грозный - смотреть онлайн в хорошем качестве https://bit.ly/ivan_groznii

how to build a professional recording studio

Hiya, I am really glad I have found this information. Nowadays bloggers publish just about gossips and net and this is really annoying. A good web site with exciting content, that is what I need. Thank you for keeping this site, I will be visiting it. Do you do newsletters? Can't find it.

נערות ליווי

אני מאוד ממליץ על אתר ישראל נייט קלאב אתר מספר אחד בישראל לחיפוש נערות ליווי, דירות דיסקרטיות,עיסוי אירוטי כנסו עכשיו ותראו לבד כמה מידע יש באתר הזה: נערות ליווי בחיפה

390727

741596

227721

320354

847600

732692

161582

483452

892996

304113

319477

374968

767838

944858

909483

401294

102595

345291

470036

622713

963746

986551

676213

917993

535548

249095

694336

345604

Best Dating Site 2022

Best Dating Sites for Real Relationships in 2022 click here

Commercial Garage Door Opener Install Tempe

An impressive share, I just given this onto a colleague who was doing a little analysis on this. And he in fact bought me breakfast because I found it for him.. smile. So let me reword that: Thnx for the treat! But yeah Thnkx for spending the time to discuss this, I feel strongly about it and love reading more on this topic. If possible, as you become expertise, would you mind updating your blog with more details? It is highly helpful for me. Big thumb up for this blog post!

Videoüberwachung

Very interesting info !Perfect just what I was looking for!

352523

354489

939860

640974

501906

207561

339170

125570

678924

223953

243929

310534

704249

612259

alarmas inalambricas para casa

I was recommended this blog by my cousin. I am not sure whether this post is written by him as no one else know such detailed about my difficulty. You are wonderful! Thanks!

719397

915623

719397

915623

996900

431079

zomenoferidov

I am not rattling excellent with English but I come up this real easy to translate.

zorivareworilon

Howdy just wanted to give you a brief heads up and let you know a few of the pictures aren't loading correctly. I'm not sure why but I think its a linking issue. I've tried it in two different internet browsers and both show the same results.

lxnhstldxlvd

Вышка фильм смотреть онлайн 1080

смотреть онлайн в хорошем качестве бесплатно фильмы

Сериалы, фильмы Видео - Буду смотреть.. Здесь смотреть онлайн в хорошем качестве бесплатно фильмы. В хорошем качестве 720 HD. Фильм Буду смотреть.

Когда необходим прием психолога?

Психолог онлайн. Консультация Когда необходим прием психолога? - 6522 врачей, 4058 отзывов.

Дивитися Фільм Бетмен (2022) українською мовою онлайн

Илоило (2013). Ilo Ilo. Буду смотреть.. Вот Дивитися Фільм Бетмен (2022) українською мовою онлайн. Прямой эфир 12 канала онлайн.

stat

stat

stat

stat

Ukraine

Ukraine

Ukraine

Ukraine

фільми онлайн безплатно

фільми онлайн безплатно

онлайн кинофильмы

онлайн кинофильмы

сериалы тут смотреть онлайн

сериалы тут смотреть онлайн

303

303

625

625

рутор торрент

рутор торрент

Лучше звоните Солу 9 серия смотреть онлайн бесплатно

Лучше звоните Солу 9 серия смотреть онлайн бесплатно

Мир Дикого Запада 4 сезон 4 серия смотреть онлайн

Мир Дикого Запада 4 сезон 4 серия смотреть онлайн

сайт фильмы

сайт фильмы

смотреть кино онлайн в хорошем качестве

смотреть кино онлайн в хорошем качестве

Site

Site

site

site

The Dental Surgery

Hiya, I'm really glad I have found this info. Nowadays bloggers publish just about gossips and internet and this is actually annoying. A good blog with interesting content, this is what I need. Thank you for keeping this web-site, I will be visiting it. Do you do newsletters? Can't find it.

смотреть онлайн фильмы в хорошем качестве

смотреть онлайн фильмы в хорошем качестве

site

site

דירות דיסקרטיות נתניה

Right here is the perfect site for everyone who wants to find out about this topic. You realize so much its almost hard to argue with you (not that I really will need toÖHaHa). You definitely put a brand new spin on a topic which has been written about for decades. Great stuff, just wonderful!

דירות דיסקרטיות בחולון - israel night club

I need to to thank you for this very good read!! I certainly loved every little bit of it. I have you book-marked to check out new things you postÖ

site

site

site

site

site

site

site

site

в москве произошла драка психологов

в москве произошла драка психологов

джошуа вусик бій коли

джошуа вусик бій коли

вечер с владимиром соловьевым сегодня прямой эфир смотреть сейчас бесплатно в хорошем качестве

вечер с владимиром соловьевым сегодня прямой эфир смотреть сейчас бесплатно в хорошем качестве

вечер с владимиром соловьевым последний выпуск смотреть

вечер с владимиром соловьевым последний выпуск смотреть

Дім дракона 2022 дивитись онлайн

Дім дракона 2022 дивитись онлайн

שירותי נערות ליווי בתל אביב

האתר מרכז תחת קורת גג אחת מידע על עיסוי אירוטי ברמת גן ודירות דיסקרטיות מאובזרות. גם אם תזמינו עיסוי מפנק לבית המלון בבאר שבע שבו אתם שוהים בבירה, האווירה תשתנה, האורות יתעממו ונרות ריחניים יהיו בכמה פינות החדר, אתם תשכבו רק עם מגבת על גופכם שתרד אט, אט, ככל שהעיסוי יעבור לחלקים השונים בגוף. מי מספקת עיסוי אירוטי בבאר שבע? שם תמצאו חדרים מטופחים ומופלאים שיאפשרו לכם חגיגה מסוקסת עם מי שאתם חושקים בו. יש שם הכל, ולא צריך לבקש או להזמין במיוחד. מצד אחד יש בעיר היצע רחב של מקומות בילוי וחיי לילה סוערים, אך מצד שני המחירים נמוכים בהרבה. כל הנערות בסטנדרטים הגבוהים ביותר וכוללות איתן מגוון רחב של אביזרים והלבשה תחתונה מטריפה. מגוון רחב של נשים: מנשים צעירות ורזות ועד לנשים בוגרות וסקסיות עם ניסיון רב בתחום. מגוון עיסויים לזוגות, לנשים מגבר לגבר. עיסוי מגבר לגבר יכול להעניק לכם רוגע, שלווה ושקט גם בקצב החיים הקדחתני. סבלני מאד, מפנק ומענג ברמה אחרת, זורם בקצב הנכון למקומות מרגשים בגוף. בעוד עיסויים במרכז אחרים שמים לעצמם למטרה לשפר את זרימת הדם ולהביא לשלווה ורוגע, עיסויים במרכז אלו מבקשים לתרום בכל הקשור להזרמת האנרגיה בגוף.

שירותי נערות ליווי בתל אביב

חדרי אירוח לזוגות הם חדרים שנבנו ותוכננו מראש להוות מקום מפגש אינטימי ולכן הם מושקעים ומאובזרים ברמה מאוד גבוהה, אם זה מיטה זוגית גדולה king size נוחה ומעוצבת, לפעמים מיטות אפריון או מיטה עגולה, תלוי בעיצוב היחידה, על המיטה מצעים לבנים, עליהם פזורים עלי כותרת אדומים או נרות ריחניים סביב, הכל כדי שיהיה לכם מקום לרומנטיקה וכדי שתוכלו להגשים את האהבה שלכם. עיסוי ארוטי עם שמנים וריחות בלתי נשכחים, מצעים חדשים ונקיים, אמבטיה מאובזרת בשמנים וסבונים נעימים, ג'קוזי, מטבח מאובזר, מיטה וחדר שינה שצריך לראות בשביל להבין והרשימה קצרה מלהכיל. אם באם לכם להתפנק בעיסוי ארוטי או במסג' מפנק ואין לכם אפשרות בדירה שלכם לקבל את הפינוקים הללו - דירות דיסקרטיות רחובות יאפשרו לכם לקבל את כל הפינוקים הללו. כל השירותים הללו הפכו את שירותי הליווי לפופולרים. חברתנו, חברת ניקיון בתים תל אביב, היא ותיקה מאוד בתחום הניקיון, מהראשונים בארץ המציעים את כל שירותי הניקיון במקום אחד. אם אתם רוצים להזמין נערת ליווי אל דירות דיסקרטיות בבת ים, חפשו באתרי האינטרנט ותמצאו שפע של מודעות מבחורות המעניקות שירותי מין ושירותי עיסוי. אל תיכנסו לפאניקה! הגעתם למקום הנכון! המטפלים באתר מקבלים מטופלים בקליניקות מקצועיות ונגישות או מאפשרים הזדמנות משובחת לקבל עיסוי בנתניה עד הבית. כאן בפורטל הבית שלנו מובטחים לכם כל השירותים שעברו אימות מדויק והכול בכדי שתוכלו להרגיש ולהיות על גג העולם גם אם אתם רק עוברי אורח בבת ים.

israel-lady.co.il

When I originally left a comment I appear to have clicked the -Notify me when new comments are added- checkbox and now each time a comment is added I receive 4 emails with the exact same comment. Is there a way you are able to remove me from that service? Cheers!

Get Free Bitcoin

This is a fascinating read! I can't believe how much I didn't know! YoBit Trading Robot

nemzetközi áruszállítás Europa-Road kft.

You are a very bright person!

דירות דיסקרטיות בחיפה ב-israelnightclub.com

אני מאוד ממליץ על אתר הזה כנסו עכשיו ותהנו ממגוון רחב של בחורות ברמה מאוד גבוהה. רק באתר ישראל נייט לאדי https://israelnightclub.com/apartments/%D7%93%D7%99%D7%A8%D7%95%D7%AA-%D7%93%D7%99%D7%A1%D7%A7%D7%A8%D7%98%D7%99%D7%95%D7%AA-%D7%91%D7%97%D7%99%D7%A4%D7%94/

דירות דיסקרטיות בצפון

אין אדם אשר יציעו לו עיסוי מפנק בבאר שבע , או בכל אזור בארץ והוא יסרב להצעה מפתה זו.אם יציעו לכם עיסוי מפנק ברגע הזה לבטח תקפצו על ההצעה. זוהי עובדה ידועה ולכן, זוגות באים לקבל טיפול של עיסוי מפנק בגבעתיים , או בכל אזור אחר בארץ תוכלו לבחור את המעסה על פי האזור שבו אתם גרים. רוצים פרטים על דירות דיסקרטיות בדרום? מבחר מעסות - אם אתם חושבים על עיסוי חושני בוודאי תשמחו לדעת שתוכלו למצוא מבחר של מעסות דירות דיסקרטיות בבאר שבע מקצועיות המגיעות ממקומות שונים. בזמן שאתה מחייג דמיין את כל האפשרויות שערב של עיסוי מפנק על ידי בחורה מקצועית פותח עבורך ותדע שעיסוי אירוטי בקריות עולה על כל דמיון. נערות עיסוי אירוטי בקריות לא שונות מבחורות "רגילות" מבחינה פיזיולגית. ההיצע הגדול של נערות ליווי בירושלים מבטיח שגם אם בחורה אחת לא תהיה זמינה, אחת אחרת תוכל להגיע אליכם תוך זמן קצר ולבלות אתכם בבילוי זוגי מסעיר. אהה כן וגם של ספא, ולא סתם ספא, בירושלים תוכלו למצוא את בתי הספא המשובחים ביותר בארץ.

israelnightclub.com דירות דיסקרטיות בקריות

כאן בפורטל הבית תוכלו לסנן את הדירה המתאימה לכם והכול על פי מיקום גאוגרפי מדויק. אף על פי שמקצב העיסוי יחסית דומה לסוגים אחרים של מסז’, לא נעשה בו שום שימוש בשמנים, לכן לרוב הוא נעשה כאשר המטופל לבוש לחלוטין בביגוד נוח ומאוורר. אנו לא מדברים רק על עיסוי קלאסי בירושלים הוליסטי או עיסויים אחרים, אלא גם על תוספי תזונה מחומרים טבעיים, תזונה נכונה באופן כללי, עשיית ספורט כדרך חיים, שימוש באופניים על פני רכב (לפחות בתוך הערים), מתקני כושר בכל מקום ועוד. כשמבצעים שיאצו, המטפלים נעזרים במתן לחץ על אזורים שונים בגוף, תוך שימוש באצבעות, באגודלים ו/או בכפות הידיים במטרה ליצור רצף לפי מקצב ספציפי. הדירות הדיסקרטיות נבחרו בצורה יסודית תוך שמירה על סטנדרטים גבוהים כמו ניקיון היגיינה, פינות מנוחה, כיבוד קל, שתייה חמה, ושירותי ליווי לעיסוי מסוגים שונים. מומלץ להתייעץ עם המעסה טרם עיסוי בהרצליה ולבחון אם ישנם אזורים ספציפיים שבהם יש להתמקד תוך כדי העיסוי או אזורים שמומלץ לא לגעת בהם.

israelnightclub.com דירות דיסקרטיות בקריות

אני מאמינה כי כל חוויה שאנו חווים, נחקקת בגוף בשתי רמות - הפיזית והנפשית וכל חוויה משפיעה על תפקודנו. הלחיצות והתחושות שהן מטמיעות בגוף משמשות לגירוי זרימת הדם והאנדורפינים בגוף. כמו כן יש נשים שהן יותר עדינות ויש יותר טוטאליות ואגרסיביות וגם את זה אפשר וניתן לבדוק מראש. אם אתה מחפש חברה אשר תוכל לבנות לך אתר או/ו לקדם את האתר שלך הגעת לחברה הנכונה. אנו קיימים למעלה מ-20 שנה (מוכרים גם כחדרי אירוח זהבה) אנו נותני יחס אישי וחם לכל אורח לא משנה גזע דת ומין מאסיפה והתחנה המכרזית ועד איכות החדרים אם זה כולל מגבות ואיכות המצעים. אם כל מה שניתן לכם במודעה אכן מגשים את עצמו. כל אישה מגשימה את רצונותיו של הגבר. מין המטפל - מה שמרגיש לכם נכון ונוח יותר - מטפל גבר, או מטפלת אישה? כמו כן, כאשר ניגשים לעשות עיסוי, מעסה מקצועי ומנוסה ידע ליצור כימיה שמטרתה טיפול טוב יותר אותו יוכל "לשדר" ולהעביר המטפל למטופל במטרה אחת - השגת ההנאה מהעיסוי ובו זמנית שאיפה לשיפור ופתרון כל הבעיות הבריאותיות. מכון מקצועי לאבחונים פסיכולוגיים, פסיכודידקטיים ודידקטיים. לחברה המפעילה רשת של 4 חנויות יכולת למתן מענה מקצועי ברמה הגבוהה ביותר לצרכי עיצוב מיוחדים ביישום של פתרונות ריהוט חדשניים תוך התאמה מלאה לדרישות האדריכל. נרשמים לקורס Linux ב HackerU-ולומדים את יתרונותיה של מערכת ההפעלה המתקדמת מסגל מרצים בעלי ניסיון מעשי רב ביישום והדרכת נושאי הלימוד בתעשיית ההיי-טק הישראלית והעולמית.

נערות ליווי

בשנים האחרונות, פיתח המשרד מומחיות בתכנון עשרות קליניקות ומרפאות. קליניקות ההופכות ל"אי של שקט" עבור המטופלים ומייצרות חוויית לקוח רב חושית המסייעת בהפחתת החששות ובהתמודדות עם חרדות טיפוליות. המעסים המנוסים של זמן מגע ביצעו כבר מאות טיפולי עיסוי מפנק בראש העין עד הבית לשביעות רצונם של כל המטופלים. עיסוי מפנק בראש העין יכול להינתן לכם על ידי מעסה גבר או מעסה אישה. עיסוי מפנק בקרית שמונה/נהריה כללי, הוא סוג עיסוי קלאסי שמטרתו להקל על המתח הגופני והעצבני. העיסוי מתבצע בדרך כלל בלבוש בגדים, וללא שמן עיסוי על מזרן או מיטת עיסוי. נכס חשוב זה התגלה על ידי המאסטרים הקדומים ברפלקסולוגיה והם גם הדגישו את עקרונות היסוד של העיסוי. במידה ואחד המטפלים לא זמין, כנראה שהוא בטיפול אז פשוט תשאירו הודעה והם יחזרו אליכם מיד בסיום הטיפול. אם הייתם משקיעים בטיפול רפואי קלאסי, למה שלא תשקיעו בעיסוי מפנק ורפואי בקרית שמונה/נהריה ? עם זאת, תוכלו לשבור את השגרה המוכרת והידועה מראש עם עיסוי בהשרון והסביבה כאנשי משפחה אתם משקיעים בילדכם וכאנשי קריירה אתם משקיעים בעבודה מסורה ומקצועית. מסאג׳ מקצועי ברמת הגולן כל האזורים חיפה והסביבה הרצליה חדרה תל אביב חולון בת ים ירושלים ראשון לציון רחובות גבעתיים אשדוד / אשקלון רמת גן ופתח תקווה באר שבע רמת הגולן נתניה … עיסוי ארוטי במרכז: ראשון לציון, תל אביב, רמת גן, רחובות, הרצליה או רעננה - זה לא משנה איפה תחפשו עיסוי ארוטי במרכז, באתר תוכלו להחשף לקליניקות המובילות בכל יישובי האזור.

שירותי ליווי

לבסוף, על מנת שתוכלו להגיע לכל טיפול של עיסוי ארוטי בבית שמש מוכנים ותפיקו ממנו את המקסימום שהוא מציע, חשוב לנו לחלוק אתכם גם מדריך קצר עם ההכנות שאסור לפספס. שיאצו היא שיטת טיפול במגע, בתחום הרפואה המשלימה שמקורה ביפן. למנהלי חברת "דא קוצ'ינה" ניסיון של שלוש דורות בתחום תכנון, עיצוב וייצור מטבחים. חברת פרסום 10 מתמחה בשיווק מוצרי פרסום, מוצרי קידום מכירות, מתנות לחגים, מתנות לעובדים, מתנות לראש השנה, מתנות לפסח לחברות ליחידים. חברת ברנד איט עוסקת במיתוג והדפסה על מוצרי פרסום, מוצרי קידום מכירות, מתנות לחגים, מתנות לעובדים, מתנות לראש השנה, מתנות לפסח לחברות וליחידים. חברת המשלט דיגיטל מציעה מגוון פתרונות שילוט ודפוס דיגיטלי ולמעלה מ-17 שנה מפיקה שלטים לכלל העסקים והחברות ומנוהלת על ידי האומן צייר פסל ומעצב גרפי מאיר דדון ששמו הולך לפניו עוד מילדותו. אורן מציעה מגוון מוצרים לשוק הפרטי והמוסדי. אורן מתקני משחקים עוסקת בהקמת גני שעשועים ציבוריים, גני ילדים ופארקי ספורט. הכוללים: מתקני משחקים, מתקני כושר וספורט וריהוט רחוב. המתמחה ב: אימון כושר אישי, אימון כושר קבוצתי, חיטוב הגוף, הצרת היקפים, ירידה במשקל.

נערות ליווי

כאשר תחום הרפואה המשלימה פורח, אך טבעי שיצוצו עוד ועוד קליניקות להשכרה. מאז סוף שנות ה-90 פועלות קליניקות משפטיות בכל בתי-הספר למשפטים בישראל. מרפאת שיניים איי סמייל הינה מרפאה ייחודית בתחום טיפולי שיניים לילדים. מסלולים הינה חברת הסעות וטיולים במרכז, המספקת שירותים ללקוחות פרטיים ועסקיים בכל רחבי הארץ. פרחי מזי בנתניה הינה חנות פרחים המתמחה בסידורי פרחים מעוצבים בשילוב אלמנטים עיצוביים מיוחדים ומקוריים. איתכם ביצירת רגעים מיוחדים באירועים שלכם כל אירוע, הוא רגע שיא עבור המארגנים שלו. לכל אחת יש מראה וסגנון מיוחד משלה וכל אחד מהגברים יכול למצוא את זו שמתאימה בול לטעם שלו והעדפותיו המיניות. לכל אחד יש את הסיבות שלו. כאשר זה נוגע לנערות ליווי, לכל אחד יש את הסיבות בגינן הוא מזמין את השירות, הסיבה שלי הייתה הגשמת פנטזיה. אבל זוהי אינה הסיבה היחידה מדוע תעדיפו דירות דיסקרטיות בקריות על פני בתי המלון. מעסים שמעניקים עיסוי בקריות ימליצו לכם להתנתק מהמכשיר כחצי שעה לפני העיסוי. בכל מקרה, הזמנתי אותה לחדר לפי שעה וכשהיא הגיעה דווקא שמחתי לגלות שהיא יותר יפה ממה שחשבתי. זה הזמן ליצור איתנו קשר ואנחנו נשמח לעמוד לרשותכם בכל שעה!

שירותי ליווי

באופן טבעי, עיסוי ארוטי, על אף היותם טיפולים מקצועיים שבהחלט מביאים להקלה על הגוף והנפש, הם כאלו שאנשים לא נוטים להתייעץ לגביהם עם חברים או בני משפחה וזה משהו שיכול להפוך את האיתור של עיסוי ארוטי בתל אביב למעט מורכב יותר. מהו עיסוי ברמת גן ? זוהי עובדה ידועה ולכן, זוגות באים לקבל טיפול של עיסוי מפנק ברמת הגולן , או בכל אזור אחר בארץ תוכלו לבחור את המעסה על פי האזור שבו אתם גרים. למשל מומלץ לישון טוב בלילה שלפני העיסוי, להגיע נקיים לכיסוי, להגיע בזמן אם מדובר על עיסוי בקליניקה של המעסה, להתרוקן לפני העיסוי, לידע את המעסה אם אתם סובלים מבעיה רפואית כלשהי. עיסוי זה מתבסס על אנרגיית הצ'י (כלומר, בכל מקום שבו יש תנועה - יש שינוי והצ'י הוא המביא לשינוי זה) ומיושם באמצעות לחצים במקומות רגישים. מסיבות רווקים/רווקות, ימי הולדת, אירועי חברה ולעתים אפילו חתונות - הם רק חלק מהאירועים שיכולים להזמין שירותי עיסוי פרטי על ידי מעסים מקצועיים. חברת בלו פוליש מספקת פתרונות מקצועיים ואיכותיים בתחום הנקיון ועם דגש על שירותי פוליש מגוונים. כל המדבירים בחברה הינם מדבירים מקצועיים בעלי היתרים מתאימים. בהליך של שירותי ליווי, נערת הליווי מגיעה עד לבית הלקוח, כאשר במידה ומסיבה כזאת או אחרת הלקוח לא יכול לקבל את השירות בביתו, הוא תמיד יוכל להזמין חדר לפי שעה, צימר, מלון או כל מקום אחר בו הוא יקבל את אותו שירות ליווי וייהנה ממנו באופן המיטבי.

נערות ליווי

נמצאו 2 קליניקות להשכרה בחדרה והסביבה מתאימים לפי החיפוש שלכם. לעיסויים בבית ישנם יתרונות ברורים, והם מתאימים בעיקר לאלו מכם שמנוהלים על ידי לוחות זמנים צפופים מאד. מאחר וישנם כל כך הרבה צימרים ברמת הגולן דקה 90 והצפון, אנחנו רוצים לדבר על הכי טובים, אלו שנמצאים גבוה שם ברשימת המארחים הכי טובים ל-2021. עיסוי אירוטי ברמת גן ייקח אותך, בעזרת גופה המושלם של הבחורה בה תבחר, אל מחוזות מיניים חדשים בהם תמיד רצית לבקר, אפילו אם על חלקם לא שמעת עדיין. עיסוי מפנק, משחרר ומרגיע רמת גן דירה פרטית, כניסה נפרדת, רק לרצינים. עיסוי מפנק, עיסוי מקצועי, עיסוי בקלניקה פרטית, מתחמי ספא מפנק, עיסוי טנטרה . כל עוד תבחרו לעבור את העיסוי במכון ספא יוקרתי ביום פינוק, הרי שתצטרכו להיפרד מלא מעט כסף. תבחר מעסה סקסית מתאימה באתר, תתקשר ותזמין לך עיסוי אירוטי ברמת גן עוד היום. עוד טיפול תרופתי לסיום היריון הוא באמצעות מתותרקסט (methotrexate), תרופה שמשמשת גם לטיפול במחלות אוטואימוניות ומחלות ממאירות. עיסוי מקצועי בבית שמש -היום ישנן דרכי טיפול רבות בגוף ובנפש של האדם, חלקן שיטות קונבציונאליות (כלומר כל מה שקשור ברפואה הרגילה שכולם מכירים - ללכת לרופא, לעשות צילומים, בדיקות דם, לקחת כדורים וכו’) ויש את הרפואה המשלימה, האלטרנטיבית אם תרצו, הכוללת טכניקות ריפוי טבעיות. עיסוי מקצועי בהשרון והסביבה -היום ישנן דרכי טיפול רבות בגוף ובנפש של האדם, חלקן שיטות קונבציונאליות (כלומר כל מה שקשור ברפואה הרגילה שכולם מכירים - ללכת לרופא, לעשות צילומים, בדיקות דם, לקחת כדורים וכו’) ויש את הרפואה המשלימה, האלטרנטיבית אם תרצו, הכוללת טכניקות ריפוי טבעיות.

נערות ליווי באילת

המרפאה משלבת טיפולי מומחים בכל תחומים כאשר צוות רפואי בעל ניסיון רב בביצוע טיפולי שיניים עומד לרשותכם. מטופלים מרוצים יש גם ברחבי הרשת וגם בהתייעצות בעל פה. במתחמי הבילוי השונים ברחבי ירושלים, תוכלו למצוא היצע הולך וגדל של מסעדות שף, פאבים וברים מקומיים, מועדוני ריקודים וקריוקי ומתחמי אירוח נוספים. טיולים ברחבי סין בהתאמה אישית ממדריכים ישראלים מנוסים שחיים את התרבות ודוברים את השפה. תנו לנו לסגור לכם את הפינה. לכן, ההמלצה היא לברור בקפידה את האפליקציה או האתר המבוקש ולקחת את המידע אך ורק מקום אמין, אשר מספק מידע מקיף בנושא. מגוון רחב של מידע בנושא רפואה ופתרונות רפואיים מתקדמים. ראשית, על מנת למצוא עיסוי מפנק בנתניה/השרון באזור שבו אתם גרים, מתחיל בטלפון כאשר אתם מיידעים את המעסה ומקבלים מידע אתם מרגישים בטוחים יותר להתחיל את העיסוי. האתר מספק שירותי סקס ליווי בבת ים ללא מין לגברים ונשים על ידי נערות סקס ליווי בבת ים לעיסוי הכי איכותיות. אני מציע שירותי עיצוב, פיתוח אתרים וחנויות אונליין לעסקים ויזמים, שירותי קידום אתרים וחנויות אונליין, ושירותי ייעוץ ופיתוח תוכנה ותשתית בענן. חברת קידום אתרים יצירתית ותחרותית.

שירותי ליווי באילת

עו״ד מורן לביאד, מוסמכת לעריכת דין משנת 2008, בעלת משרד לדיני משפחה, מתמחה בגישור וניהול משברים במשפחה. עו״ד מורן לביאד, פיתחה את מודל הגישור האימוני ומוסמכת לעריכת ייפוי כח מתמשך. החלטת להחליף את השיש באמבטיה, לרענן את המטבח או לשדרג את מראה גרם המדרגות. מרפאות ד״ר דוידסון מתמקצעים בטיפולי אסתטיקה לא פולשניים בהזדקנות העור להשגת מראה צעיר, רענן וטבעי. קורס לימודי אסתטיקה המיועד לרופאים (בלבד) המעוניינים להרחיב את אופקיהם בתחום הרפואה האסתטית. ניסים שגב מוסיקה לאירועים-, dj בתחום האירועים באהבה גדולה למוסיקה כבר יותר מ- 20' שנה קריאת קהל מעולה, מגוון רחב של מוסיקה . מגוון רחב של צעצועי מין למכירה שיתאימו לגברים, נשים וזוגות. אתר המרכז מגוון צעצועי מין הנפוצים והמוכרים ביותר מכל העולם. מכוני ספא מפנקים באיזור המרכז מציעים מסלולי עיסוי אירוטי. יש לדבר מראש עם המעסה לגבי סוג העיסוי הרצוי לכם, כך שהמעסה יוכל לדעת באיזהו שיטת עיסוי עליו או עליה לנקוט. הקניית קריאה באמצעות שיטת "5 דקות ביום" המעניקה פתרונות יישומיים ויעילים לבעיית הקושי בקריאה ובהבנת הנקרא, באופן חדשני ומהיר של לימוד קריאה, המותאם לילדים, נערים ומבוגרים, כאחד.

נערות ליווי באילת

בכל חדר תוכלו ליהנות מחדר שינה גדול ומרווח עם מיטה זוגית מפנקת אשר מוצעת במצעי כותנה לבנים, חדר רחצה מעוצב עם מקלחת, שירותים ומגבות רכות, מטבחון מצויד בכל טוב עם מוצרי חשמל, כלי הגשה ופינת קפה עשירה.. אם יש לך כל מיני פנטזיות ודברים שאתה רוצה להגשים - יש מצב טוב שויקטוריה עשתה את זה כבר. הרוסיה הכי פצצה למספר שעות של הגשמת פנטזיות. דנה היא פצצה שתעביר… צעירה כוסית על תיתן לך עיסוי חם לוהט ומשחרר. בא לכם דווקא איזו נערת ליווי רוסיה צעירה - תמצאו פה כאלה בחורות בשפע. זה משהו שלא תפגשו במרכז, שם תמצאו נערות ליווי רוסיות (או כמובן אוקראיניות בלבד). נערות ליווי ילמדו אותם הכול על נשים, ובסוף הגברים שחשבו שהם מנוסים עוד יבואו לבקש מהם עצות. בין יתר הדברים שהם עושים או בוחרים לייצר, שירותי ליווי בצפון בחיפה ובקריות הם חלק מזה וכך או כך הם מפגישים לא מעט אנשים עם קשת נרחבת. שירותי ליווי עם נערות ליווי בצפון אחד מהשירותים המוצעים בפורטל הבית שלנו קשור בבחירת נערות ליווי איכותיות מהצפון שנבדקו ונבחרו בקפידה. ניתן כמובן להזמין גם עיסוי זוגי בקריות עד הבית לפינוק רומנטי וקסום.

נערות ליווי באילת

ישנם זוגות המעוניינים לחגוג יום מאושר, אירוע או פשוט ליהנות מחוויה רומנטית משותפת. המעסה אמנם יהיה זה שמעסה אתכם וירפה את גופכם, אך המוכנות המנטלית שלכם היא זו שתאפשר לכם ליהנות מרוגע ושלווה לאורך העיסוי. ליהנות מכל סוגי העיסויים. הפתיחות הרבה והמודעות לנושא העיסויים בכלל ולעיסויים ארוטיים בפרט, הביאו לכך שכיום בכל שכונה ונקודה בעיר תל אביב פזורים להם מקומות דיסקרטיים ונגישים בהם תוכלו להתפנק בשעה קלה של עיסוי ארוטי בתל אביב. עיסוי בתל אביב ? כאשר עיסוי מפנק בתל אביב , נעשה בביתכם, תוכלו להתרווח על הספה עם כוס משקה האהוב עליכם ולחוש את ההקלה לאחר העיסוי כאשר הגוף והנפש רק יודו לכם. תוכלו להזמין מתוך מגוון של עיסויים את העיסוי שלו אתם זקוקים כמו: עיסוי מרגיע ונעים, עיסוי משחרר, עיסוי בשמן חם, עיסוי טנטרי, עיסוי מקצועי ומפנק בתל אביב . לפני שאתם מתאמים עיסוי באזור חיפה, כדאי לבדוק אל מול המעסה עד כמה הוא מנוסה בעיסוי אותו אתם רוצים לקבל. 2.אל תוותרו על רחצה: מעבר לכך שחשוב מאד שתגיעו נקיים אל העיסוי, הרי שמקלחת מרגיעה. חשוב מאד להחזיר את הגוף ל"מצבו הטבעי" רגע לפני שאתם שבים אל השגרה. כאשר עיסוי מפנק בחיפה והסביבה , נעשה בביתכם, תוכלו להתרווח על הספה עם כוס משקה האהוב עליכם ולחוש את ההקלה לאחר העיסוי כאשר הגוף והנפש רק יודו לכם.

נערות ליווי באילת

אתה יכול להתקשר אלי בכל עת. כמובן שתמיד תוכלו לשלוח הודעת וואטסאפ לבעל החדר אם אתם מעדיפים במקום להתקשר. אז בין אם זו חוויה לרגל אירוע מסוים ובין אם זה חוויה של סתם פינוק כי בא לכם לעשות משהו כיף יחד, אז הגיעו בהקדם אל בתי ספא בנתניה לחוות רומנטיקה בשיאה. מאוד יכול להיות שתגלו שאותו חדר לפי שעה שאתם מחפשים, ממוקם בקרבת מקום המגורים שלכם, ומכיוון שאין שום דבר אשר יעיד על קיומו (לא סתם הם נקראים גם חדרים דיסקרטיים) אתם בכלל לא יודעים שהוא נמצא שם. בכדי ליהנות מנפלאות העיסוי השוודי אין כל סיבה שתטוסו למדינה הסקנדינבית, אלא שתוכלו להישאר בעיר המגורים שלכם! חדרים לפי שעה בבאר שבע ניתן להשכיר בביצוע הזמנה מראש, באמצעות שיחת טלפון פשוטה או באמצעות הזמנה אינטרנטית כאשר כיום ניתן לבחור חדר מתוך מגוון רחב של סוגי חדרים אשר נמצאים בשכונות שונות בעיר. מהי דירה דיסקרטית בבאר שבע? כך שלא משנה אם אתם מחפשים חדרים לפי שעה בירושלים, או מעדיפים דווקא חדרים לפי שעה בבאר שבע, כאן תוכלו לקבל את כל הפרטים לגבי האפשרויות השונות המוצעות לכם באותו העיר או האזור. אם הכאב הפך להיות חלק מחייכם, אם אתם סובלים מבעיות גב או מפרקים ואינכם מוצאים מזור, כדאי שתדעו שאפשר לנצח את הכאב.

שירותי ליווי באילת

ניתן להתחיל את הטיפול בשיחה קצרה בין המטפל למטופל, כדי ליצור קרבה ולהעניק תחושת ביטחון למטופל. תוך כדי העיסוי המקצועי, המטפל מניח את האבנים באזורים שונים בגוף כמו עמוד השדרה, הבטן, החזה, הפנים, הגפיים וכפות הידיים והרגליים. במהלך עיסוי אבנים חמות המעסה מניח אבנים חלקות, שטוחות וחמות על אזורים ספציפיים לאורך הגוף. עיסוי באשקלון בסגנון אבנים חמות מעשיר את גופנו בחום, המייעל את פעילויות הטיפול והניקיון של מערכת החיסון. נערות ליווי הדבר המדהים ביותר זה לפגוש אנשים באמצע הדרך ולפעמים גם להגשים איתם את הפנטזיה הלוהטת ביותר. כן זה קורה כאן ועכשיו כשסקס אדיר מבין את המוטל עליו ומעניק לכם אפשרות לפגוש נערות ליווי מדהימות או דירות דיסקרטיות בסמוך לאזור המגורים שלכם. מהיום לא עוד נסיעות רחוקות, הכול קורה כאן ועכשיו, אתם נכנסים לפורטל ובוחרים עבורכם את הבילוי המושלם ביותר. נערת ליווי פרטית שמארחת בקליניקה פרטית יכולה להציע לך עולם ומלואו: החל מעיסוי חושני ומפנק ועד בילוי אינטימי אתה ואם תרצה - גם עם עוד חברה. מנגד, כל עוד תקבלו עיסוי באשקלון בלבד לאורך כ-45 דקות ועד שעה, המחיר שתצטרכו לשלם יהיה נוח הרבה יותר ויהפוך את חווית העיסוי לנגישה גם לכם! ריפיון הגוף מגיע לאחר העיסוי באשקלון, אך לאורך העיסוי המטופל לעיתים ירגיש חוסר נוחות ומעט כאב בשל הלחיצות.

ליווי באילת

המרפאה משלבת טיפולי מומחים בכל תחומים כאשר צוות רפואי בעל ניסיון רב בביצוע טיפולי שיניים עומד לרשותכם. מטופלים מרוצים יש גם ברחבי הרשת וגם בהתייעצות בעל פה. במתחמי הבילוי השונים ברחבי ירושלים, תוכלו למצוא היצע הולך וגדל של מסעדות שף, פאבים וברים מקומיים, מועדוני ריקודים וקריוקי ומתחמי אירוח נוספים. טיולים ברחבי סין בהתאמה אישית ממדריכים ישראלים מנוסים שחיים את התרבות ודוברים את השפה. תנו לנו לסגור לכם את הפינה. לכן, ההמלצה היא לברור בקפידה את האפליקציה או האתר המבוקש ולקחת את המידע אך ורק מקום אמין, אשר מספק מידע מקיף בנושא. מגוון רחב של מידע בנושא רפואה ופתרונות רפואיים מתקדמים. ראשית, על מנת למצוא עיסוי מפנק בנתניה/השרון באזור שבו אתם גרים, מתחיל בטלפון כאשר אתם מיידעים את המעסה ומקבלים מידע אתם מרגישים בטוחים יותר להתחיל את העיסוי. האתר מספק שירותי סקס ליווי בבת ים ללא מין לגברים ונשים על ידי נערות סקס ליווי בבת ים לעיסוי הכי איכותיות. אני מציע שירותי עיצוב, פיתוח אתרים וחנויות אונליין לעסקים ויזמים, שירותי קידום אתרים וחנויות אונליין, ושירותי ייעוץ ופיתוח תוכנה ותשתית בענן. חברת קידום אתרים יצירתית ותחרותית.

1894

1894

ליווי באילת

ישראלית מהדרום? ברזילאית? כל נערות הליווי נמצאות אצלנו כאן עוברות אימות על בסיס יומי שזמינות ועובדות היום. בחורה ישראלית סקסית במיוחד רוצה להיפגש איתך במיקום דיסקרטי בעיר צעירה עם גוף מדליק מענגת אותך עם עיסוי איכותי בביתה רוצה ליהנות מחוויה שתיזכר לך לכל החיים? ישנן דירות דיסקרטיות בהן אפשר ללכת ביחד עם בת הזוג/ מאהבת לפינוק משותף. כאן בדיוק כאן נפתחות בפניכם אין ספור אפשרויות של עינוגים בלתי נגמרים בזכות דירות פרטיות באזור חולון. להבדיל מהדירות הדיסקרטיות באזור המרכז, דירות דיסקרטיות בצפון ובחיפה קשה יותר למצוא. הגעתם למקום הנכון: היכנסו כבר עכשיו לאחת הדירות הדיסקרטיות בראשון לציון ולא תתחרטו. בעלי הדירות מפרסמים את הדירות שבבעלותם, וכל שאתם צריכים לעשות זה לברור , לגלול ולאתר בין ההיצע הרחב. עיסויים בנס ציונה הניתנים לכם בבית מאפשרים לכם להמשיך לנוח מיד לאחר שהעיסוי מסתיים, מבלי שאתם צריכים להטריד את עצמכם בשאלה איך אתם חוזרים לביתכם. עיסוי משולב הוא שם כולל למגוון עיסויים העושים שימוש בשיטות העיסוי הידועות בתוספות טכניקות ייחודיות שפותחו בעידן המודרני. אם תחפשו קצת, תמצאו, כי העיסוי מפנק בקרית שמונה/נהריה היה אחד מהטכניקות היעילות והעתיקות בעולם לטיפולי מרפא. כאשר עיסוי מפנק בנתניה/השרון , נעשה בביתכם, תוכלו להתרווח על הספה עם כוס משקה האהוב עליכם ולחוש את ההקלה לאחר העיסוי כאשר הגוף והנפש רק יודו לכם.

ליווי באילת

לעתים קרובות ליווי ליווי עדיין כוללים שירותים מיניים, ואלה אינם מקרים בודדים, אלא בפועל עולמי. חשוב כמובן מי המעסה, לעתים גברים יעדיפו אישה מעסה ונשים יעדיפו גבר מעסה. עיסוי אירוטי בגבעתיים עיסוי אירוטי בגבעתיים כולם מחפשים את אותו השירות אבל לא תמיד מוצאים את אותה החוויה, בעידן בו המון גברים רוצים לפרוק עול ולהשאיר את שגרת החיים בצד כל מה שנשאר זה למצוא את ההנאה הגדולה - עיסוי … הגעתם לפורטל גירל פור אסקורט המרכז עבורכם את כל המודעות מנערות ליווי ודירות דיסקרטיות בירושלים, בצעו חיפוש מצאו לכם את העיסוי המושלם, הפינוק שחלמתם עליו גם בירושלים זמין לכם עכשיו. חשוב לדעת כי כל המודעות של המפרסמים באתר נשיקה הצהירו כי השירותים הניתנים הם שירותי עיסוי בלבד. כמו כן, אם אתם מחפשים עיסוי ארוטי בהוד השרון באזור, סביר מאד להניח שאתם גם תוהים מה היתרונות של הטיפול הזה בכלל, ומתברר שגם זה משהו שאנשים לא כל כך מבינים לעומק ולכן נחלוק אתכם גם את המידע החשוב הזה. היום העיסוי הפך לחלק מאד חשוב בחיינו וברור לנו … העיסוי התאילנדי בראש העין - הינו עיסוי ביבש שמתבצע לרוב על המזרון (אפשר גם על מיטת טיפולים) . במקרים כאלה כדאי לעדכן את בעל המקום מראש ולהשתמש בשירותי האתר על מנת לחסוך זמן וכסף.

арестович про зеленського

арестович про зеленського

נערות ליווי בתל אביב

בוודאי תמצאו עבורכם נערות ליווי בחיפה או בקריות המשתמש בתמונות אמיתיות ואפילו בסרטונים המוצגים באתר. דירות דיסקרטיות בבאר שבע - הרגע שכל הפנטזיות מתגשמות לך במקום אחד יש רגעים בחיים בהם אפשר ואפילו רצוי להגשים את כל מה שרץ לכם בראש, אחד מהם זה להזמין דירה דיסקרטית בבאר שבע ולהיווכח בעצמכם כי החלום שלכם גם הוא יכול להפוך מציאות. כן, זה אפשרי וזה אפילו הכרחי, זה יכול לשנות לכם את החיים מהקצה אל הקצה ולכן אנו בפורטל הבית מזמינים אתכם להצטרף ללא חשש לשירות שיעשה סדר לא רק בחיי המין שלכם אלא הרבה מעבר לכך. אם פעם היה נחשב שירות זה יקר מדי שהרי היום יותר ויותר גברים ונשים מחפשים לשלב בחיי המין שלהם מפגשים שווים ביותר עם נערת ליווי בכל רחבי הארץ ובפרט בבאר שבע- בירתה של הנגב. כעיר סטודנטיאלית, באר שבע מתאפיינים בחיי חברה עשירים ומגוונים, כאשר מוקדי הבילוי של העיר באר שבע הולכים ומתרבים במהלך השנים האחרונות. במהלך השנים האחרונות התפתחה בבאר שבע סצנת בילויים תוססת ודינמית בה לוקחים חלק הסטודנטים המתגוררים בעיר, תושבי העיר ובליינים מכל אזור הדרום. במהלך העשורים האחרונים, ובעיקר מתחילת המאה הנוכחית, באר שבע זוכה לתנופת פיתוח בכל תחומי החיים, כאשר יותר ויותר מרכזי תעשייה מתקדמת מוקמים ברחבי העיר והיא נחשבת כיום לבירת הסייבר של מדינת ישראל לנוכח ריכוז חברות ההייטק הרבות הפועלות בשטחה של העיר.

1727

1727

נערות ליווי בתל אביב

יש כמה מאפיינים מיוחדים שמלווים את השירות שניתן על ידי נערות ליווי בחולון. למשך 50 דקות (ולעתים גם יותר), יש לכם אפשרות להתנתק משגרת היום, הרעשים והקולות, המחוייבויות שלכם, המשפחה והעבודה - ופשוט לצלול לאווירה קסומה, מרגיעה ומלטפת! אמביינט יוקרתי רגוע , מוסיקה מלטפת, לך נשאר רק להתקלח להתנתק ולהתמסר.. דירות דיסקרטיות ברחובות מחכות לכם לכל אורך השנה. דירות דיסקרטיות באזור הצפון, בדומה לדירות דיסקרטיות בכל עיר אחרת בישראל, הן דירות המיועדות לצרכי אירוח דיסקרטי ואינטימי מכל סוג. אזור התעשייה בחולון מספק שלל דירות דיסקרטיות, חדרים לפי שעה. השירות בדרך כלל אינו זול, במיוחד ביחס לדירות דיסקרטיות, אבל המסאג' שתקבלו מנערת ליווי הוא פי כמה וכמה ב-99% מזה שתקבלו בעיסוי אירוטי בכל דירה דיסקרטית באשר היא. שיאצו בדרך כלל נעצה על משטח מיוחד, על הרצפה או על מיטת טיפולים נמוכה. משך העיסוי נע בדרך כלל בין 50 דקות לשעה וחצי. בהתאם לדרישותיכם - ממיקום העיסוי, דרך סוג העיסוי ומין המעסה - יוצגו בפניכם התוצאות הרלוונטיות. זוהי דרך מעולה לשחרור המתחים וגורם להרפיה. אני סטודנטית איכותית שנראית ממש מעולה.

נערות ליווי בתל אביב

יש להכין את האווירה וההכנה הנפשית והגופנית, לפני שמתחילים עם עיסוי מפנק ברחובות . יש להכין את האווירה וההכנה הנפשית והגופנית, לפני שמתחילים עם עיסוי מפנק בקרית שמונה/נהריה . עיסוי זוגי בבית הלקוח - לא רק מסיבות רפואיות. אנחנו מבצעים את עבודתנו באופן הטוב ביותר בהתאם לצרכים של הלקוח. אמרלד ספא הנודע, השוכן במלון דן פנורמה שבתל אביב, מעניק לתושבי המרכז שירותי עיסוי עד הבית, ממש בבית הלקוח. באילו מקרים עיסוי בקריות יכול לסייע? כמו כן, ניתן להזמין עיסוי בקריות בקליניקות המקצועיות בהן פועלים המטפלים המכילות את כל הציוד הדרוש ואווירה מושלמת לעיסוי מפנק ומשובח. אם אתה גר לבד אז אין בעיה, אתה יכול להזמין אליך את מי שאתה רוצה ומתי שאתה רוצה, אלא אם כן אתה מעוניין להוסיף קצת ריגוש לחיים או לחלופין, לשמור על הפרטיות שלך. אחד הדברים היותר מסעירים זה לדעת עם מי אתם עומדים לבלות את השעות הבאות וכאן נכנסות דירות דיסקרטיות בתל אביב לתמונה. ברגע שתגיעו מוכנים מבחינת תקציב, יהיה הרבה יותר קל לסנן מקומות אירוח שאינם עומדים בדרישות הכספיות שלכם מלכתחילה. מן הסתם, פנייה אל מעסים שאינם מקצועיים, עלולה לייצר את התוצאה ההפוכה במלוא מובן המילה. נשמח לבנות עבורכם את הטיול המושלם בהתאם להעדפותיכם.

2300

2300

1806

1806

1368

1368

549309

344334

803674

4wz7shpt2g

549309

hx7utdjxt1

549309

3443344hhnt0l0hi

kaajbl18qw

344334

549309594ex2i6e2

344334

549309

344334

985965

`z'z"${{%{{\

985965

krqx\z`z'z"${{%{{\

985965

pvzpylw\z`z'z"${{%{{\

985965

tkyowgw\z`z'z"${{%{{\

549309

1cmm1c6egq

803674

5pv931hxasz96g82v8fhme75pwvpjggf47wvoie63

549309

7t1b73lzeu3baic4zajjqgb7tyzrnikm8e02spid7

li7pwhad38spzw1ioo8xfu0lico5cw90xspgh38rx

344334

985965

e1gifat6m1biipkb7hrqynje157yvpuhi9ax2ks8h

549309

9y8dc5q1jw8dfkh64colvig9y04tskrkfc70znpbe

Content Generator

Artificial intelligence creates content for the site, no worse than a copywriter, you can also use it to write articles. 100% uniqueness :). Click Here:👉 https://stanford.io/3FXszd0

site

site

2234

2234

Content Generator

Free. Sign up to receive $100, Trade to receive $5500. Click Here:👉 https://millionairego.page.link/free

דירות דיסקרטיות בעפולה

אין אדם אשר יציעו לו עיסוי מפנק בבאר שבע , או בכל אזור בארץ והוא יסרב להצעה מפתה זו.אם יציעו לכם עיסוי מפנק ברגע הזה לבטח תקפצו על ההצעה. זוהי עובדה ידועה ולכן, זוגות באים לקבל טיפול של עיסוי מפנק בגבעתיים , או בכל אזור אחר בארץ תוכלו לבחור את המעסה על פי האזור שבו אתם גרים. רוצים פרטים על דירות דיסקרטיות בדרום? מבחר מעסות - אם אתם חושבים על עיסוי חושני בוודאי תשמחו לדעת שתוכלו למצוא מבחר של מעסות דירות דיסקרטיות בבאר שבע מקצועיות המגיעות ממקומות שונים. בזמן שאתה מחייג דמיין את כל האפשרויות שערב של עיסוי מפנק על ידי בחורה מקצועית פותח עבורך ותדע שעיסוי אירוטי בקריות עולה על כל דמיון. נערות עיסוי אירוטי בקריות לא שונות מבחורות "רגילות" מבחינה פיזיולגית. ההיצע הגדול של נערות ליווי בירושלים מבטיח שגם אם בחורה אחת לא תהיה זמינה, אחת אחרת תוכל להגיע אליכם תוך זמן קצר ולבלות אתכם בבילוי זוגי מסעיר. אהה כן וגם של ספא, ולא סתם ספא, בירושלים תוכלו למצוא את בתי הספא המשובחים ביותר בארץ.

דירות דיסקרטיות באשקלון

היות ואין ספק לגבי היתרונות של בילוי עם נערות ליווי, הסוגיה המרכזית מבחינת הלקוחות היא היכן לקיים את המפגש. ואז קיבלתי פרטים על תחום הליווי דרך חברה ומכיוון שאני דיי משוחררת באופיי ואין לי בעיה עם הגוף שלי, החלטתי שזה המסלול בשבילי, לא לעבוד קשה מדי ולהרוויח משכורת גבוהה. תוכלו לשריין דירות דיסקרטיות ברחוב בלפור, יוספטל או דרך בן גוריון ולהזמין עיסוי אירוטי למקומות מפנקים ואינטימיים. בין הלקוחות של דירות דיסקרטיות בחדרה ניתן גם למצוא זוגות נשואים המגיעים לבילוי משותף. כיום עומדות בפניך מספר אפשרויות לבילוי לילי סוער עם נערת ליווי פרטית כאשר דירות דיסקרטיות בטבריה הן ללא ספק האפשרות האידיאלית. אם בא לך אחלה ערב, מפנק ומענג עם בחורה צעירה ויפה שיועדת גם איך לעשות את זה ויש לה הרבה יותר מכוונות טובות- שירותי ליווי בתל אביב מיועדים לך. שירותי ליווי בתל אביב- שירותי מין מקצועיים לגברים שיש להם סטנדרטים גבוהים! תל אביב- מה אין בה? אין צורך לצאת מהבית בכלל, בטח שלא להשקיע זמן ומאמץ בלמצוא חן בשביל לקבל בסוף זיון. חדרים להשכרה לפי שעה יכולים לאפשר להרבה זוגות להשקיע בזוגיות ולא לוותר על האינטימיות ועל התשוקה האישית שלהם.

דירות דיסקרטיות בקרית אתא

אתר לפי שם לעצמו למטרה להציע את השירות האיכותי ביותר בעבור מי שרוצה חופשה קצרצרה, איכותית, לא יקרה וברמה גבוהה. חדרים לפי שעה מאפשרים לבאים אליהם נסיעה איכותית, אלגנטית, מעוצבת, מצד אחד - ומצד שני את המחיר הטוב ביותר, הגמישות הגדולה ביותר בתאריכים ובשעות, ושליטה במרחק, ובזמן ההגעה. אם פעם הייתם חייבים לקבוע מראש נסיעה לבית מלון באזור רחובות - היום אפשר לעשות זאת בדקה התשעים בלי לשלם על זה מחיר, באמצעות חדרים לפי שעה ברחובות והסביבה, האיכותיים ביותר. דירות דיסקרטיות מתאימות למי שרוצה לתאם את המפגש עם נערות ליווי בחולון באווירה אקסקלוסיבית ולמי שלא מוכן להתפשר על הפרטיות שלו. מה תרצה לקבל מנערת ליווי בהרצליה, השירותים שלנו יכולים לספק הכל. מומלץ לנסות עיסוי זוגי אם אתם מחפשים להתחבר עם האדם השני ברמה עמוקה יותר או שאינכם יכולים לשאת את המחשבה ללכת אל עיסוי בשרון בלעדיו. בין אם כך או ככה, אתם יכולים למצוא את כל אלו במתחמי אירוח כפרי בצפון. אירוח דיסקרטי לפי שעה בחדר בחדרה, להנאתכם חנייה דיסקרטית, גקוזי, פינת ישיבה, תאורה רומנטית, טלוויזיה, מזגן, ערכת קפה, אביזרי רחצה, מיני בר, ספריית סרטים, מערכת סאונד, אירוח נעים וסולידי, חדר דיסקרטי בחדרה, לרשותכם חנייה דיסקרטית, חייגו עכשיו והזמינו חדרים להשכרה לפי שעות בחדרה.

דירות דיסקרטיות בבת ים

כמובן שאתם יכולים גם להתייעץ עמנו לגבי בחירה של דירה דיסקרטית, ואנו נשמח להמליץ לכם על מקומות מעולים שתוכלו להיות מרוצים מהם. מעוניינים למצוא דירה דיסקרטית בנס ציונה ? ישנם אנשים שמקבלים עיסויים למטרות פינוק וכייף בביתם ולפעמים מגיעים לדירה דיסקרטית בפתח-תקוה אך גם ישנם אנשים המבקשים לעבור עיסוי במרכז בעקבות כאב מסוים. ישנם אנשים שמקבלים עיסויים למטרות פינוק וכייף בביתם ולפעמים מגיעים לדירה דיסקרטית בחיפה אך גם ישנם אנשים המבקשים לעבור עיסוי בצפון בעקבות כאב מסוים. מדובר על מעין "כרטיסיית עיסויים בפתח-תקוה!" שאתם רוכשים מראש, כך שתוכלו לקבוע עם המעסה מפעם לפעם בהתאם ללוח הזמנים שלכם ולצרכים שלכם. עיסויים בקרית שמונה/נהריה משפרים באופן ניכר, את כל מערכות הגוף וכן, הם מרגיעים את מערכת העצבים, מה שיגרום להפחתת המתחים. זה יכול להיות בגלל שאתה רוצה לשמור על קו מחשבה מסוים בקרב הקולגות שלך, להרשים את האקסית שאתה יודע שגם היא תהיה נוכחת, או פשוט בגלל שאתה לא צריך שההורים שלך יערערו שוב על ההחלטות שלך כשאתה משתתף בחתונה של בן דוד. המרצה שלי בערך בן 40, כן כן, אני שמעתי כבר את כל התגובות.

http://bit.ly/

אנו מספקים שירות של עיסוי עד הבית לזוגות, ליחידים ואף לימי כיף, קבוצות ומשפחות. היתרון של נערות ליווי בקריות ואף נערות ליווי בחיפה ולמעשה בכל אזור הצפון, או שאתה יכול לבחור אם להזמין אותן לביתך או למלון, בית פרטי. אך אם אתם מעוניינים בעיסוי מפנק בחולון לצורכי הנאה ורגיעה או לרגל אירוע שמחה מסוים, תוכלו לקרוא במאמר זה על שלושה סוגי עיסויים אשר מתאימים למטרה זו ויעניקו לכם יום בילוי מפנק ואיכותי במיוחד אשר סביר להניח שתרצו לחזור עליו שוב כבר בשנה שאחרי. באתר תוכלו לשלב בין מידע על דירות דיסקרטיות יוקרתיות, בילוי אינטימי עם קוקסינליות וכמובן ספא מפנק עם או בלי בני זוג. העוסקים בעיסוי השוודי שמים דגש על האווירה, שבה נעשה העיסוי לצורך כך. שירותים שונים - כל נערת ליווי יכולה להציע שירותים מעט שונים מהאחרת, כך שלמי שיש בקשות נוספות, לצד השירותים הסטנדרטים, כדאי שישים דגש גם על הנושא הזה בהליך של בחירת הבחורה (או הבחור) לצורך המטרה. בכל מדינה אפשר למצוא שירותים שכאלו, אך לא בכל מדינה תמצאו את אותה הרמה.

zmozeroteriloren

Thank you for another informative blog. Where else could I get that kind of information written in such an ideal way? I've a project that I am just now working on, and I have been on the look out for such information.

https://ivoryvalentine.com/regions/Discreet-apartments-in-Kiryat.php